An Energy Services Provider

(ESP), based in Texas, caters to 3 million retail customers in more than 10 states. The ESP works with a number of energy sources such as natural gas, coal, wind, and nuclear reactions. To ensure a more satisfactory customer experience, they built the infrastructure for the following departments of operations.

- On-boarding

- Installations

- Utilization Inspection

- Bill Generation

- Payment

The ESP Used a Customer Relation Management (CRM)

system to centralize and manage their end-customer information.

- The CRM captures everything from energy utilization, bill payment, to customer complaints & resolutions.

- It also directs every customer to their respective financial institutions to process their bills. Once the bills are paid, the financial institutions send across transaction details in individual files for each customer. These files usually contain account numbers, customer identifier, and transaction details.

Our client, the energy service provider, needed these separate transaction files to be associated with the customer’s profile in the CRM.

Due to the large volume of transactions, identifying the transactions and attaching them to the respective customer profile turned out to be a daunting task.

Manually identifying transactions from financial institutions turned out to be a tedious process with a high error rate.

To Eliminate This Crutch

the ESP did their fair amount of research online as to who could hasten their manually tedious process. They came across Nalashaa, an IT solutions provider that has been helping enterprises move up the ladder.

Without wasting any time, the subject matter experts (SME) from Nalashaa analyzed the end-to-end payment reconciliation process and the process flow that was in place. There was also a round of discussion with the stakeholders to further analyze the business side of things to gain clarity on business rules and exceptions. Once the requirements and rules were identified, the SMEs knew just what to do.

The ESP’s Workflow needed RPA Bots

to eliminate the high error rate caused by manual efforts. Nalashaa implemented RPA bots to take up the process of identifying the customer profiles and attaching the concerned payment files to the respective profiles for auditing purposes.

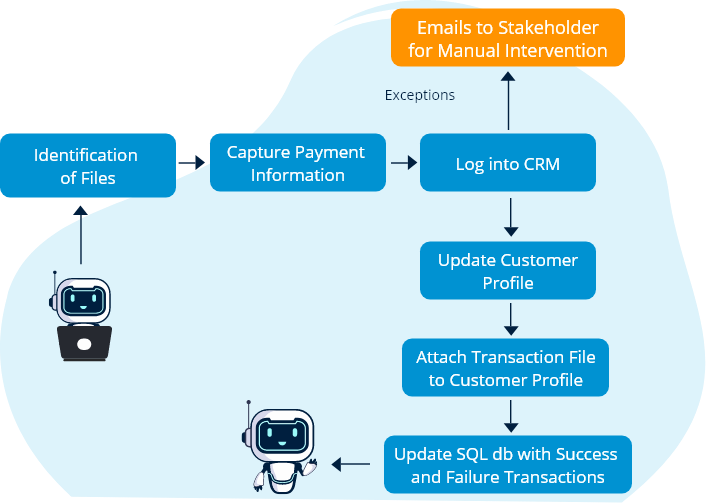

In The Picture

Initially, the RPA bot accesses the payment files and identifies the payment and customer information. It then updates the CRM with the above details. In the case of anomalies/exceptional cases, it sends error reports to an email address monitored by an ESP employee. At the end of this process, project status reports are made available to the stakeholders for further action.

Advantages Experienced by the ESP

Tools that Helped with RPA Implementation

Get Your Operations the Automation Boost It Needs

RPA Implementation Services to Help You Achieve Your Business Goals.