iSeries Cloud Hosting Migration Blueprint: Architecture, Tools & Pitfalls That Could Derail Your Move

Jun 10, 2025

he conversation around iSeries cloud hosting is no longer about “if” but “how soon.” As IT budgets face pressure, and CIOs aim for agility without sacrificing mission-critical reliability, cloud hosting for IBM i (formerly AS/400) has emerged as a practical ...

read more

Nalashaa Earns ISO 9001 & 27001 for Quality & Security

Apr 15, 2025

In a significant milestone that underscores its commitment to excellence and trust, Nalashaa Software Solutions has successfully been re-certified for ISO 9001:2015 ...

read more

CTO Guide: Future-Proof Your AS400 Applications

Apr 03, 2025

AS400 systems have been the backbone of enterprise operations for decades, offering stability and reliability....

read more

Avoiding Common Pitfalls in RPA Governance Implementation

Mar 31, 2025

Robotic process automation implementation services are transforming enterprises, but without a structured governance framework, organizations often face scalability issues, compliance risks, and automation failures....

read more

Hidden RPA Costs That Cause Failures: What Vendors Don’t Tell You

Mar 29, 2025

Many organizations dive into Robotic Process Automation (RPA) with the promise of cost savings, efficiency, and scalability. ...

read more

AS400 Security Cuts 90% Compliance Risk in Finance

Mar 29, 2025

The financial sector relies heavily on AS400 (IBM i) systems for their robustness and stability. However, security vulnerabilities in AS400 can lead to compliance risks, data breaches, and financial penalties. ...

read more

AS400 Automation Uncovers Manufacturing Bottlenecks

Mar 29, 2025

Manufacturers running on AS400 (IBM i) often experience unexplained slowdowns, production inefficiencies, and data synchronization issues – even when their systems seem to be running fine. ...

read more

SaaS Churn Reduction via Product Engineering

Mar 27, 2025

Every SaaS business faces the challenge of customer churn – losing users before they can deliver long-term value. While some churn is inevitable, a significant portion is preventable with well-implemented SaaS churn reduction strategies. ...

read more

Why RPA Projects Fail — Fix It with Real Insights

Mar 27, 2025

Robotic Process Automation (RPA) is often sold as a silver bullet for business efficiency, yet a staggering number of implementations fail to deliver expected ROI. Enterprises invest heavily in RPA projects only to encounter stalled initiatives, broken workflows, or even complete abandonment....

read more

Automate Smarter, Scale Faster with RPA for Small Business

Mar 27, 2025

Robotic Process Automation (RPA) has long been associated with large enterprises, but in 2025, small businesses will leverage automation like never before. ...

read more

AS400 Report Automation | Spool to Dashboards

Feb 28, 2025

For decades, AS400 (IBM i) has powered enterprises across industries, handling critical operations with unmatched reliability....

read more

Startup Product Development: Avoid Pitfalls

Feb 28, 2025

Launching a startup is an exhilarating journey, but the path to building a successful product is riddled with challenges....

read more

Automate Finance Reconciliation for Peak Accuracy

Feb 28, 2025

Businesses are increasingly turning to automation to enhance efficiency, reduce errors, and optimize workflows....

read more

AS400 Cloud Hosting: Solve Integration Challenges

Feb 13, 2025

For decades, IBM’s AS400 (or IBM i) has been the backbone of mission-critical applications across industries such as manufacturing, banking, retail, and logistics....

read more

10 IDP Trends in 2025: Smart Document Processing

Feb 13, 2025

ntelligent Document Processing (IDP) continues to evolve as organizations leverage it to automate manual, document-centric processes. ...

read more

RPA 2025: Human-in-the-Loop for Complex Tasks

Feb 11, 2025

Robotic Process Automation (RPA) has been one of the most commonly used technologies in enterprise automation. From automating repetitive tasks to improving operational efficiency...

read more

Off-the-Shelf vs Custom Software: What You Must Know

Feb 11, 2025

Off-the-shelf software solutions often appear as cost-effective, quick fixes for businesses looking to digitize operations....

read more

DevOps Observability: Tools for Microservices

Jan 08, 2025

The rise of DevOps microservices has revolutionized how modern applications are developed and deployed. ...

read more

DevOps Report 2024: Key Salesforce Trends

Nov 15, 2024

The 2024 State of Salesforce DevOps report by Gearset provides a comprehensive snapshot of the Salesforce DevOps picture....

read more

Custom Data Pipelines Drive Smarter Business Growth

Nov 12, 2024

Today, businesses thrive or falter based on how well they manage and utilize data. Data pipelines, the backbone of modern data-driven decision-making, are essential for collecting, processing, and distributing data across the organization....

read more

Why Invoice Automation Is a Smart Business Move

Nov 12, 2024

For finance and procurement teams, processing invoices is often a time-consuming and error-prone task. ...

read more

RPA in Supply Chain: Worth the Investment?

Oct 22, 2024

supply chains are under constant pressure to perform. From managing inventory and tracking shipments to handling customer orders and maintaining supplier relationships, the complexities of supply chain management can be overwhelming....

read more

AS400 to AWS Migration Cuts Cost, Boosts Flexibility

Oct 21, 2024

Enterprises relying on legacy systems like AS400 (IBM i) are faced with the challenge of modernizing their IT infrastructure to stay competitive....

read more

AS400 App Development with Containers | Step-by-Step Guide

Oct 21, 2024

Businesses worldwide are constantly looking for ways to stay competitive, agile, and scalable. ...

read more

AS400 Inventory System for Retail Accuracy

Oct 14, 2024

Inventory management is the lifeblood of any retail operation. Efficient stock control, timely replenishment, and real-time visibility are critical to ensuring smooth operations....

read more

Low-Cost Mobile App Dev: Smart Outsourcing Tips

Oct 01, 2024

Having a mobile app for your business today isn't just a luxury, but essential. However, the costs associated with mobile app development can be a significant burden, especially for small businesses and startups....

read more

AS400 EDI Integration for Retail | Solve Data Issues Fast

Aug 20, 2024

Electronic Data Interchange (EDI) has become a cornerstone for supply chain operations in the retail industry....

read more

Fix AS400 Accounting Errors | Ensure Data Accuracy

Aug 13, 2024

AS400 accounting software can face data integrity issues that impact financial reporting. Learn how to fix these issues for accurate data. ...

read more

Mastering AS400 API Authentication: A Guide

Aug 07, 2024

The world of AS400, also known as IBM iSeries, has long been a cornerstone of business-critical applications and data processing. ...

read more

Predictive Churn Analytics for Better C-Suite ROI

Aug 02, 2024

In today's competitive business environment, retaining customers is more critical than ever. ...

read more

20 Best Cloud Cost Management Tools to Optimize Your Cloud Spend

Jul 31, 2024

Cloud computing has transformed the way businesses operate, providing unparalleled scalability, flexibility, and cost-efficiency....

read more

Fix API Rate Limits with Smart Throttling Techniques

Jul 26, 2024

APIs are the backbone of modern software development, enabling seamless communication between different software systems....

read more

Enhancing Your AS400 Experience: Top 10 Things to Do

Jul 17, 2024

The AS400, now known as IBM i, is a powerful and reliable platform that has been the backbone of many organizations for decades....

read more

AS400 WMS: Fix Supply Chain Inefficiencies Fast

Jul 11, 2024

Companies are continually seeking ways to streamline operations, reduce costs, and improve customer satisfaction. ...

read more

AS400 RPG Support: Solve Key IT Leader Challenges

Jul 10, 2024

When it comes to AS400, also known as IBM i, RPG (Report Program Generator) remains a critical programming language that supports a multitude of business applications....

read more

AS400 Developers Aligned to Your Business Goals

Jul 10, 2024

AS400, also known as IBM i, has long been a cornerstone in enterprise IT environments. Its reliability, robustness, and scalability make it an invaluable asset....

read more

AS400 Cloud Hosting – What's in It for Modern Enterprises?

Jul 01, 2024

A cornerstone of enterprise computing for decades, AS400 (IBM iSeries) has earned a reputation for robust performance, exceptional data management capabilities, and unparalleled reliability. ...

read more

AS400 Report Automation: What It Is & How to Do It

Jun 28, 2024

Automated report generation on AS400 enhances efficiency, accuracy, and timeliness, empowering businesses with real-time data insights and streamlined processes. ...

read more

AS400 ETL Optimization for Peak Performance

Jun 28, 2024

In the world of enterprise computing, the AS400 (IBM i) system has been a reliable workhorse for decades....

read more

Modern AS400 Monitoring Tools for Manufacturing Firms

Jun 27, 2024

Maintaining optimal performance and ensuring seamless operations are crucial, especially in an industry such as manufacturing....

read more

AS400 Security Levels: What You Need to Know

Jun 24, 2024

As businesses increasingly rely on robust IT systems for their operations, ensuring the security of these systems is paramount. ...

read more

Top AS400 Modernization Tools You Need in 2025

Jun 18, 2024

Modernizing AS400 (IBM iSeries) systems is crucial for businesses aiming to stay competitive in today's fast-paced technological landscape....

read more

AS400 Modernization with IBM RDi | Boost Code Quality

Jun 14, 2024

To go about AS400 application modernization is a critical task for many businesses, particularly those relying on legacy systems to manage essential operations. ...

read more

Legacy Code Modernization with Automation Tools

Jun 13, 2024

Organizations are constantly seeking ways to improve their IT infrastructure to stay competitive. ...

read more

Software Implementation Plan | Key Considerations

Jun 11, 2024

The successful implementation of software systems has become a critical factor in driving organizational growth and competitiveness....

read more

How to Fix “The Developer of This App Needs to Update It to Work with This Version of iOS”

May 29, 2024

Are you getting the dreaded "The developer of this app needs to update it to work with this version of iOS" message? It’s like your app is throwing a tantrum, demanding a shiny new upgrade. ...

read more

IaaS Adoption Tips | Cloud Engineering Services Guide

May 20, 2024

Businesses today face increasing pressure to innovate, adapt, and deliver value to customers faster than ever before. ...

read more

Why Enterprises Need AS400 Software Services in 2025

Apr 10, 2024

IBM i/AS400 is over three decades old but its popularity remains unchallenged even today. With the system still hosting mission-critical tasks for organizations across verticals, AS400 is anything but obsolete. ...

read more

AS400 Inventory Management with Web GUI Tools

Apr 10, 2024

Legacy AS400 systems have long served as the backbone of inventory management for countless businesses. ...

read more

AS400 and SAP

Feb 08, 2024

As organizations contemplate whether to modernize their existing iSeries system or integrate newer technologies into the existing ecosystem, a strategic compass is crucial. ...

read more

5 Statistics That Will Make You Want to Build a Web App, Today!

Dec 29, 2023

The decisions made by ISV professionals carry profound implications for the future of their organizations, but also for the software landscape as a whole, given their ability to create software products that can disrupt the market....

read more

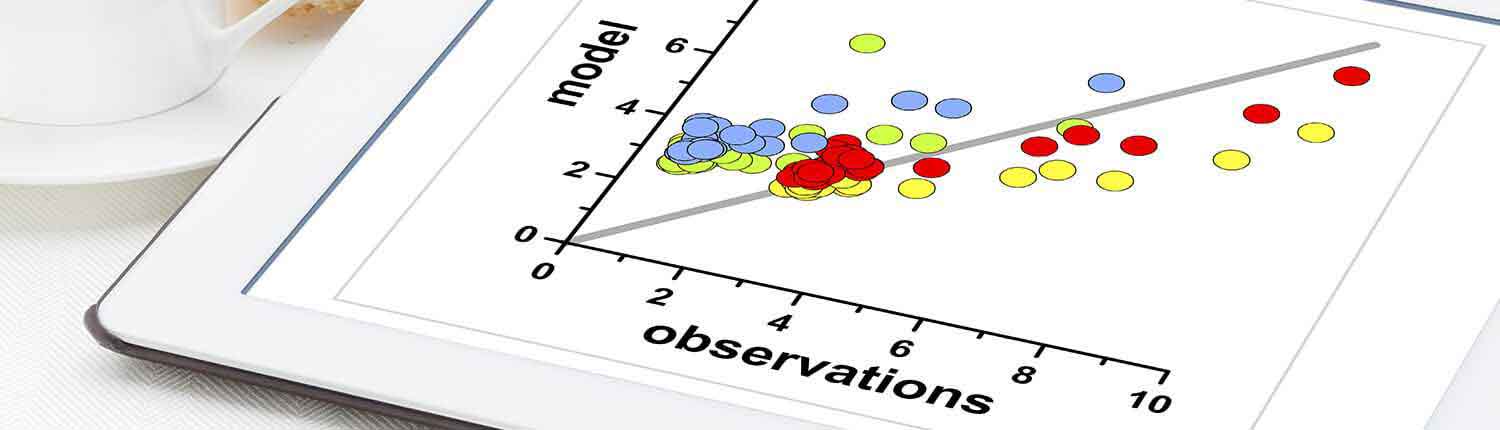

Boost Insights with Smart Data Visualization Services

Dec 29, 2023

Data analytics is the linchpin of modern business success, and within the expansive domain of data analytics, smart data visualization services are coming to be a force to be reckoned with....

read more

Cloud Services for Retail - What Can it Do for the Industry?

Dec 26, 2023

The retail industry is one where consumer expectations and market dynamics change at the blink of an eye. In situations like this, the role of technology becomes pivotal....

read more

Building a Robust Cloud Migration Strategy – The ‘How’ and ‘Why’ of it

Dec 22, 2023

Cloud implementation has evolved from being a mere technological shift to a strategic necessity for businesses striving to stay competitive....

read more

Brownfield vs Greenfield: Choosing the Right Path for Modern Software Development

Dec 21, 2023

The software landscape is a swiftly changing terrain, demanding agility and foresight. Independent Software Vendors (ISVs) often find themselves at a crossroads, contemplating the choice between Brownfield vs Greenfield software development....

read more

Bitbucket vs Gitlab vs Github – What Should be Your Go-To in 2024?

Dec 20, 2023

When it comes to collaborative coding, the battle of GitHub vs GitLab stands tall and plays a huge role in shaping the product engineering landscape....

read more

DevOps Success Guide: What You Must Know Today

Dec 18, 2023

The journey of DevOps implementation transcends a mere methodology. It represents a shift, redefining the synergy between software development and IT operations....

read more

Predictive vs Adaptive Dev: Choose Your Strategy

Dec 04, 2023

Choosing the right product development strategy is a critical determinant of project success. The decision between Predictive and Adaptive development approaches requires an expert understanding of their intricacies. ...

read more

DevOps vs Waterfall: Why Agile Wins Every Time

Dec 04, 2023

Choosing the right software development methodology is crucial for success. While the Waterfall model has been a longstanding approach, its limitations have become more apparent in today's fast-paced and ever-evolving industry....

read more

How Can ISVs Solve Customization Challenges with LC/NC Solutions?

Nov 30, 2023

The ability to address customization challenges swiftly and efficiently is a critical differentiator....

read more

Ensure Secure Web App Development with These Cybersecurity Strategies

Nov 29, 2023

Where technological innovation is the key to success, building a sound and secure web app development strategy stands as a critical task. ...

read more

Must-Have Mobile Application Features That You Cannot Miss

Nov 29, 2023

The mobile revolution is more than a trend—it's a necessity. As businesses increasingly recognize the importance of going mobile, the need for strategically incorporating must-have features in mobile applications becomes paramount....

read more

CI/CD and DevOps: Understanding Their Unique Roles in 2025

Nov 29, 2023

Precision and speed stand as the bedrock for Independent Software Vendors (ISVs). Two methodologies, Continuous Integration and Continuous Delivery (CI/CD) and DevOps, often surface as linchpins in achieving these goals....

read more

Solve Issue Management Challenges with ServiceNow Managed Services

Nov 28, 2023

The efficiency of issue management has always stood as a critical benchmark. Here, ServiceNow emerges as a game-changer...

read more

IoT for Manufacturing: Improve Inventory Control

Nov 28, 2023

Where precision and efficiency reign supreme, the role of IoT and RPA solutions in inventory management takes center stage. ...

read more

Warehouse Automation for Peak Order Season Prep

Nov 28, 2023

Navigating the peaks of e-commerce demand is both a revenue boon and a logistical challenge....

read more

Master Node.js & Microservices for Live Data

Nov 23, 2023

The demand for real-time data processing has become a linchpin for success. Independent Software Vendors (ISVs) are beginning to recognize the potential of microservices and Node.js in achieving unparalleled excellence in real-time data processing. ...

read more

React vs React Native: Which Should You Choose?

Nov 20, 2023

The choice between React and React Native has become a pivotal decision, especially for Independent Software Vendors (ISVs)....

read more

Cloud Migration Strategy: Learn How to Make It Most Effective

Oct 31, 2023

The cloud has become the cornerstone of innovation and efficiency for businesses across the globe. ...

read more

Championing Data-Driven Strategy: A Guide for the ISV C-Suite

Oct 31, 2023

Data has solidified its role as the backbone of decision-making, especially for Independent Software Vendors (ISVs). ...

read more

Cloud Agnostic Solutions - The Key to Vendor Independence?

Oct 27, 2023

Let's kick things off by demystifying Cloud Agnosticism. At its core, being cloud agnostic isn't just about using multiple cloud engineering services, or hopping between them....

read more

Tailored Software Solutions in IT Strategy

Oct 25, 2023

The strategic utilization of IT resources stands is important for success. Among the numerous components that constitute IT strategy...

read more

Hybrid Application Experts, Assemble! Strategies and Best Apps

Oct 23, 2023

In an era where digital innovation is not just a buzzword, but an imperative, businesses must consistently evolve to stay ahead. ...

read more

Websites or Web Apps? What’s Right For You!

Oct 20, 2023

Choosing between a website or a web application for your digital platform strategy can often seem like a perplexing decision....

read more

10 React UI Frameworks That Will Lead the Way in 2025

Oct 18, 2023

Choosing the right web app development tools can be a daunting task, especially when it comes to selecting a user interface (UI) framework for your React projects. ...

read more

Node vs React vs Angular: A Comparative Study

Oct 17, 2023

In the dynamic world of front-end web development, selecting the right JavaScript framework is akin to choosing the perfect tool for a complex job....

read more

Avoid Common Cloud Pitfalls | Strategy Tips Inside

Oct 17, 2023

In the fast-evolving business landscape, cloud computing has taken center stage....

read more

Understanding SDLC: Different types of SDLC Models

Oct 13, 2023

Embarking on a custom enterprise software development project is akin to setting sail on vast, unpredictable waters....

read more

From Code to Compliance: Unpacking the PHP 8.2 Update

Oct 12, 2023

When it comes to making your mark in the realm of Independent Software Vendors (ISVs), innovation is everything. ...

read more

Secure Data Transfer: Best Practices & Tools

Sep 04, 2023

In today's digital era, ISVs sit at the nexus of innovation and transformation, with data being their lifeblood. ...

read more

Navigating IBM i Modernization in 2025

Aug 30, 2023

Speed is of the essence, and technology is inseparable from it. Businesses are on the threshold of a remarkable transformation – a metamorphosis of their IT landscapes. ...

read more

Java in Software Product Engineering: The Long-Lasting Edge for ISVs

Aug 28, 2023

Where technologies rise and fall, Java has emerged as a stalwart that stands the test of time....

read more

How to Transform Your AS400 Green Screen into a Modern GUI in 2025

Aug 22, 2023

What’s the first picture that comes to your mind when you think about AS400/i Series? ...

read more

Demand Forecasting Mastery: From Age-Old Wisdom to AI-Driven Precision

Aug 21, 2023

In the intricate tapestry of business, the threads of success are woven with foresight and strategic planning....

read more

Data Lakes vs. Data Warehouses - Choosing the Right Architecture

Aug 21, 2023

In the ever-expanding realm of data-driven decision-making, businesses are grappling with the pivotal decision of how to manage and derive insights from their voluminous data....

read more

Want to Upgrade to IBM i V7? Learn Why You Should

Aug 10, 2023

RPG (Report Program Generator) is a high-level programming language developed by IBM in 1959 to provide a systematic way to process data and generate reports on early IBM systems....

read more

Best Python Framework for Web Development

Aug 07, 2023

Python web development has emerged as a clear favorite among software developers worldwide....

read more

Power of IBM i Modernization: IBM i 7.4 Upgrade and Beyond

Aug 03, 2023

Staying up to date is crucial for businesses to remain competitive and agile. ...

read more

Use Cloud Data Warehousing for Cybersecurity

Aug 02, 2023

The cybersecurity landscape is constantly evolving, making the management of cyber threats a pressing challenge for organizations across the globe....

read more

Mastering Blue-Green Approach with CI/CD for Seamless Deployment

Aug 01, 2023

Continuous integration and continuous deployment (CI/CD) have become indispensable practices in the world of DevOps services, ensuring swift and dependable delivery of software updates. ...

read more

iOS App Dev Guide: Tools, Tips & Best Practices

Jul 28, 2023

Building an iOS app requires not just proficiency in coding and design, but also a deep understanding of mobile app development services and its various technical aspects, such as platform compatibility, performance, and security. ...

read more

Mastering AS400 Cloud Migration: Expert Strategies to Conquer Key Challenges

Jul 27, 2023

In the world of technology, digitization is not just a buzzword - it's a necessary evolution....

read more

Top AS400 Cybersecurity Tips for IBM i Systems

Jul 27, 2023

As technology continues to advance, so do the ever-evolving cybersecurity threats that plague the IT landscape....

read more

AS400 Health-checks: A Comprehensive Guide to System Optimization

Jul 25, 2023

AS400 systems have always been the backbone of countless businesses across the globe....

read more

Across the Platform to Brilliance: Realizing Your App-tential

Jul 19, 2023

Imagine a world where you can reach a wider audience, streamline development processes, and ensure a consistent and delightful user experience across diverse platforms....

read more

2025 Data Integration Strategy Best Practices

Jul 17, 2023

Data integration is like the master conductor that brings data together from various sources to create a harmonious symphony of insights. ...

read more

Progressive Delivery for Better CI/CD Rollouts

Jul 14, 2023

Organizations today look to adopt changes quickly while ensuring a smooth user experience and minimizing risks....

read more

Azure Blob Storage: Your Comprehensive Guide

Jul 13, 2023

Storage accounts is one of the services in Microsoft Azure that provides cloud storage, where massive amounts of unstructured data can be stored. ...

read more

Hybrid Cloud Helps Businesses Take Control Over Everything Cloud

Jul 05, 2023

Cloud computing has revolutionized the way businesses operate, providing scalable and flexible infrastructure to drive innovation and growth....

read more

How can your fitness organization do more with data?

Jul 04, 2023

In today's fast-paced world, fitness organizations face increasing pressure to deliver exceptional customer experience while streamlining their operations....

read more

Maximize Crowdsourcing ROI with Cloud Efficiency

Jul 03, 2023

Crowdsourcing platforms have revolutionized innovation and problem-solving, from solving complex problems to gathering valuable insights across various domains...

read more

2023 IBM i Survey: Modernize with AS400 Services

Jun 26, 2023

The 2023 IBMi Marketplace survey results reveal several key findings....

read more

From Chaos to Clarity: Automating Unstructured Data with RPA and IDP

Jun 26, 2023

In today's digital era, businesses are inundated with vast amounts of unstructured data that resides in various documents such as invoices, purchase orders, contracts, and forms....

read more

Application Maintenance Services: Solving the 3 Challenges That Drain Enterprise Agility

Jun 19, 2023

In today's ever-evolving technological landscape, application maintenance services play a pivotal role in ensuring the smooth operation of software systems...

read more

Top 3 Legacy System Issues & How to Solve Them

Jun 12, 2023

In the dynamic realm of technology, organizations often grapple with the complexities of legacy systems....

read more

How to Overcome the Common RPA implementation Challenges?

Apr 06, 2023

Robotic process automation implementation services not only assist in taking over manual tasks but also help speed up the entire operations across your organization....

read more

Cost of RPA Implementation Services |Nalashaa Solutions

Apr 06, 2023

Employees in an organization spend days working on administrative tasks that negatively affect their productivity....

read more

Learn how to train an RPA Bot to minimize human supervision

Apr 06, 2023

Robotic process automation implementation services help create software bots that automate any task that is routine, rule-based, repetitive, and logical....

read more

Protect Valuable Data with These 10 Best Practices in Data Governance

Mar 29, 2023

Efficient data governance can go a long way in ensuring an organization's data quality and regulatory compliance....

read more

Data Analytics for PMs: Gain User Insights Fast

Mar 16, 2023

Are you a thriving product manager? Worried about what you users need? Going clueless in the middle of nowhere? Let’s dig together and see how data analytics can help you with this....

read more

BI for Fraud Detection: Smart Strategies That Work

Feb 07, 2023

One of the key aspects of effective fraud detection is the use of data....

read more

BI in the Cloud: Pros, Cons, and Key Challenges

Feb 07, 2023

Business intelligence (BI) has become an essential tool for organizations to make informed decisions and stay ahead of the competition....

read more

How RPA and IoT are Transforming Predictive Maintenance for Logistics

Feb 01, 2023

The logistics industry constantly faces new challenges to keep up with the demands of modern business....

read more

How is RPA Improving Customer Service Across Channels?

Jan 20, 2023

Repetitive tasks such as data entry, data validation, call routing, billing, and invoices are common issues in customer service....

read more

Why Forward-Thinking Banks Are Turning to RPA for Operational Agility and Customer Trust

Dec 30, 2022

As time goes on, technology has been penetrating every walk of life. In the banking sector too, it has found firm footing....

read more

Top 3 RPA Best Practices for Developers

Dec 29, 2022

Robotic Process Automation services have long been known to help businesses save time, eliminate manual errors, and boost employee satisfaction rates....

read more

How can RPA Services be the Solution to Human Resource Problems?

Dec 28, 2022

A Human Resource team is integral to the functioning of any business, given the key role it plays in the entire business ecosystem. ...

read more

3 Ways Business Intelligence Services Help Logistics Sail Smart

Dec 23, 2022

In the aftermath of the covid-19 pandemic, a good many Industries have gone through massive transformation; the logistics industry is no exception....

read more

3 Ways Business Intelligence Enables High Quality Sales Performance

Dec 23, 2022

The main aim of Business Intelligence (BI) is to eliminate gut instincts and help businesses act on data-driven insights....

read more

How BI Services Improve Airline Customer Experience

Dec 15, 2022

The Airline industry is one that isn’t just tasked with getting flyers from one point to another....

read more

Self Service Business Intelligence: 3 Reasons Why It Makes Sense

Dec 15, 2022

Businesses normally depend on business analysts and data scientists to work with data and derive actionable insights from it....

read more

4 Ways Business Intelligence Can Solve Major Challenges for Insurers

Dec 11, 2022

Insurance organizations regularly receive a lot of data, that can be difficult to handle with outdated processes. ...

read more

EdTech UX: Course Selection Stage Hidden Challenges

Nov 30, 2022

The course selection stage in the EdTech app user journey is profoundly important for educational app development companies....

read more

Into the EdTech User Journey: The Scope for Retention During Exit

Nov 30, 2022

EdTech app users who have arrived at the end of their user journey are often considered lost. But as they say it ain't over till it's over....

read more

Automation In Manufacturing: How Can It Help?

Nov 30, 2022

When we’re talking about the manufacturing industry, automation is a technology that has been on the rise for a decade....

read more

Into the EdTech User Journey: The Challenges in The Sign-up Stage

Nov 29, 2022

In the previous publication of our EdTech app development blog series, we established the importance of examining the EdTech app user journey to enhance user retention. ...

read more

EdTech App Onboarding: A Guide for Developers

Nov 29, 2022

Upon completing the sign-up stage, the next step in the user journey for an EdTech app user is onboarding. ...

read more

Into the EdTech User Journey: Enabling Frictionless Course Consumption

Nov 29, 2022

The COVID-19 pandemic had a silver lining in its grim shadow for educational app development companies. ...

read more

A Critical Analysis of the Education App User Journey

Nov 28, 2022

EdTech, or educational technology, has made significant headway, especially since the outbreak of the COVID-19 pandemic. ...

read more

2022 EdTech User Journey Review: Roadmap for 2023

Nov 25, 2022

In the previous blogs, we covered the stage-wise challenges in the critical evaluation of the 2022 EdTech user journey series. ...

read more

The Need for AS400 Integration Services in 2025 and Beyond

Oct 20, 2022

AS400 systems are decades old. They were manufactured by IBM as mid-range servers for heavy processing tasks for retail, manufacturing, logistics industries. ...

read more

Rethink Your AS400 Architecture - Here's Why It Makes Sense

Sep 16, 2022

iSeries Modernization has been on the radar of CTOs/CIOs for quite some time now. There are many types of modernization techniques and cloud migration is one of them. ...

read more

Why is There a Need for AS400 Software Services in 2022?

Sep 15, 2022

Organizations across industries rely on the IBMi for their core operations and it does deliver on what it promises – reliable performance. ...

read more

Evaluating and Enhancing Your Mobile App Development Strategy in 2022

Sep 14, 2022

The computing performance of mobile phones today easily rivals that of laptops or desktops. As a result, most Original Equipment Manufacturers (OEMs), including the infamously apprehensive Apple Inc....

read more

6 Key Parameters for RPA Feasibility Assessment

Sep 14, 2022

RPA Implementation is one of the most crucial steps in digital transformation. It is known to enhance efficiency, productivity, and customer engagement, helping businesses move ahead of competition. ...

read more

AS400 Migration: Is iSeries Hardware Obsolete Now?

Jun 30, 2022

IBM introduced the first mid-range computers/servers called the system/38 in 1978 for enterprises. ...

read more

How API Analytics Improve Business Performance

Jun 15, 2022

Did you know that analytics from APIs can help improve your business outcomes? Here’s how. ...

read more

10 Quintessential Elements to Look for in an RPA Support Package

Jun 07, 2022

The journey to automation excellence starts with implementing RPA. As markets evolve and their demands change over time, businesses must rally their forces and ensure that their service offerings are up to the expected standards. ...

read more

iSeries Cloud Migration: Why and What to Migrate?

May 20, 2022

iSeries systems have been the backbone of performance for many processes in many industries for three decades now. ...

read more

7 Step Must Have RPA Implementation Checklist: A C-suite Guide

May 19, 2022

It is a joyous day when an organization decides to adopt RPA. Say goodbye to repetitive, time-consuming processes, and hello to enhanced productivity and efficiency. ...

read more

Top 5 Tips for Choosing a Big Data Services Partner

May 09, 2022

Businesses across the globe accumulate data from multiple sources ranging from emails, mobile apps, websites, IoT devices, and more. ...

read more

Top REST API Challenges & How to Overcome Them

Apr 21, 2022

In the present-day world of heightened connectivity, the demand for Application Programming Interfaces (APIs) is growing every day. ...

read more

AS400 Documentation: Where and Why it is Crucial?

Apr 21, 2022

System documentation is one of the most overlooked processes by many organizations leveraging AS400. ...

read more

DevOps Challenges and how to address them?

Apr 21, 2022

Are you facing many challenges with your DevOps maintenance? You’re not alone. Many organizations rush to implement DevOps without an in-depth understanding or a clear vision. ...

read more

IaaS Adoption Tips | Cloud Engineering for Business

Apr 18, 2022

Businesses are adopting cloud services, trying to move up in the market and stay at par with the competition. ...

read more

Why Should IBM i CTOs Consider Database Solutions as a Priority?

Apr 05, 2022

Have you ever wondered what the world would be without data? Every single thing in the world is governed by data, and IT systems are not an exception. ...

read more

What Is ETL and Why Should Leaders Care About It?

Mar 31, 2022

A business organization’s ability to utilize data to increase its revenue, profitability, and longevity gives it a significant advantage over the competition. ...

read more

4 Areas of Improvement within the Manufacturing Industry

Mar 31, 2022

Automation is quickly rising up in the world and replacing repetitive human tasks, making way for human minds to conquer bigger ideas. ...

read more

Make Error-free Custom Software a Reality with Functional Testing

Mar 31, 2022

Crafting custom software involves charting requirements and scope, planning for API integration points, writing code, building it, testing it for various aspects, and then deploying it for the user’s environment. ...

read more

Analyzing Business Intelligence - Hype, or a Genuine Need?

Mar 31, 2022

Business Intelligence (BI) is a buzzword gaining momentum among the C-Suite group. . It is as popular as Artificial intelligence (AI), Natural Language Processing (NLP) and Machine Learning (ML). ...

read more

RPA for Manufacturing: Boost Efficiency and Output

Mar 29, 2022

Manufacturing is a labor-intensive industry. This opens up space for those involved to be the victims of manual errors, poor visibility in operations resulting in poorer management and ultimately a decrease in productivity. ...

read more

Vendor Selection Checklist: Choosing the Right IBM i Software Support Partner

Mar 25, 2022

Legacy systems like iSeries have been the backbone of many businesses for over three decades now, especially for businesses that are into manufacturing, transportation, freight, etc. ...

read more

An overview of Data Analytics as a Service (DAaaS)

Mar 24, 2022

Data analytics engines and cloud-hosted applications drive industries to help them stay ahead of the game with business insights. ...

read more

10 Emerging Trends in DevOps for 2025

Mar 22, 2022

DevOps is a very popular software development and deployment methodology. It helps the Development and Operations teams make software development quicker, faster, and error-free. ...

read more

Why Your AS400 System Can't Sail Smooth Without Expert Support

Mar 15, 2022

AS400 has been around for three decades now and the users’ faith in it is as strong as its systems’ integrity and durability to run modern applications. ...

read more

Is AS400 with RPA More Than Just a Trifle Solution?

Mar 11, 2022

AS400/iSeries systems have been popularly used by businesses for over three decades now. The hardware limitations are constantly being ironed by IBM; they are releasing newer models with more horsepower to better process applications. ...

read more

4 Reasons Enterprises must pick Bespoke software over COTS

Feb 28, 2022

In the world of software development, questions still linger around the viability of developing custom software over using commercial-off-the-shelf software (COTS). Let us put an end to this quest, once and for all. ...

read more

Stay updated on custom software development technology trends

Feb 23, 2022

Looking for custom software services, and unsure of where to begin? Your search ends here. Go through the list of the latest custom software development technologies and build your organization with the most suitable solution. ...

read more

Cloud-native Engineering Security Trends 2022

Feb 21, 2022

Cloud computing has picked up pace in the last decade, and yet there are areas that prove to be ambiguous and challenging to work with, security being one of them. ...

read more

Why there is a need for AS400 Modernization in 2022?

Feb 21, 2022

AS400 systems have been around for three decades now. Although it is a very reliable system, it does have its fair share of disadvantages, even in 2022. ...

read more

Cloud native development services to help you out.

Feb 18, 2022

Heard of cloud technology yet? Who hasn’t, right? However, can you name the differences between cloud and cloud-native technologies? Before jump-starting, stop using the two terms interchangeably. ...

read more

How to prepare your AS400 for migration?

Nov 22, 2021

System migration is a cumbersome process, this is a universal truth but when it comes to migrating off of a legacy system like Application System 400, the stakes are higher than the average. ...

read more

Building Intuitive Software Experiences: A Strategic Guide to UI/UX for Product Success

Oct 22, 2021

Experiences are not easy to manufacture, and memorable experiences do not shy away from being difficult to deliver. When it comes to the digital world, experiences matter the most. ...

read more

Optimize Your Offerings For Mobile

Oct 21, 2021

Everyone has a mobile phone on them these days. Businesses leaving out their offerings from the mobile screens stand a lot to lose as consumers these days prefer to get their work done in the easiest and quickest way possible. ...

read more

AS400 Security: Are you Marked safe?

Sep 29, 2021

Evolution is gradual. It happens uninterrupted in the background, the immediate effect of which might seem negligible but when collated over years, the results are gigantic....

read more

Stay Away from QA Setbacks

Sep 06, 2021

In the previous blog we saw how things could go wrong with a test strategy and derange the whole QA process, and send teams into confusion. ...

read more

Identify and Overcome your QA Mishaps Before it’s too Late

Aug 26, 2021

The world is in a race to make lives easier. Promising a good experience comes with the added baggage of promising quality. ...

read more

Things to Consider Before You Migrate Your AS400

Aug 23, 2021

Back in the 80s, introduction of AS400 was one of the most powerful waves that hit the IT industry. ...

read more

Step up your Release Management

Jul 29, 2021

The world of technology is ascending to increasing levels of efficiency every day. With this in mind, it is imperative for businesses to figure out methods to keep up with the growing demands of the market. ...

read more

Top 10 Areas for IBM i Modernization

Jul 29, 2021

Application Systems 400, a.k.a AS400, was first introduced by IBM in the year 1988. Three decades, and the mighty IBM i system is still sheltering mission-critical tasks of industries across different verticals. ...

read more

Optimize your DevOps Processes, Starting Today

Jul 26, 2021

Businesses these days are all about collaboration. Solutions and innovations are no longer unidirectional. ...

read more

Top 4 DevOps Challenges and Solutions

Jul 19, 2021

Expectations are on the rise as is connectivity. The more connected the globe is, people expect solutions to perform faster and smoother. ...

read more

What is API Management, and why do we need api management ?

Jul 09, 2021

The democratization of the internet has enabled and empowered people and businesses to access the required information from anywhere at any time. ...

read more

Performance Management for IBM i: A step towards excellence

Jun 08, 2021

When it comes to performance, AS400 is second to none. But what’s buried under the confetti is its archival performance management strategies. ...

read more

Integrated Web Services for IBM i. Why does it make sense?

Apr 28, 2021

AS400, iSeries and the machines that came early on the IBM evolutionary stem were not built to interact with the internet but it provides you an unrivaled performance that’s second to none. ...

read more

Remodeling Customer Service with RPA in 2021: 8 Use Cases

Apr 26, 2021

With markets getting more competitive and profit margins shirking at a worrying rate, enterprises are attempting to reimagine their customer service ecosystem. ...

read more

Leveraging RPA to Transform Project Management

Apr 23, 2021

In continuation of the blog series ‘RPA for business processes’ which includes sales, manufacturing, and many more, this time we zero in on another critical area – project management. ...

read more

How RPA Reshaped Manufacturing Post-COVID

Apr 05, 2021

The manufacturing industry is largely driven by manual processes. The ‘manual way’ of conducting operations was not just approved but also profitable (ostensibly). ...

read more

Give IBMi Machines Space to Breathe. Migrate Jobs to the Cloud.

Mar 18, 2021

Even after 30 years of continuous technological evolution, AS400 still stands strong as the solid, one-word answer to most of the business operations across mid and large-size enterprises. ...

read more

RPA and Profitability Interlocked in the Logistics Arena

Mar 15, 2021

The supply chain and logistics industry has forever been dependent on manual processes, with automation limited to just a few areas of operations. ...

read more

Leveraging RPA to Reimagine Sales: 10 Critical Use Cases

Mar 07, 2021

The Covid-19 crisis has upended some of the most dependable business models prevalent before the virus struck the world. ...

read more

iSeries/AS400 Documentation: Now is the Time to Work on it

Feb 03, 2021

When Application System 400, aka, AS400 was first introduced by IBM in the late 1980s, system documentation wasn’t a part of the conventional System Development Life Cycle (SDLC). ...

read more

Winning the 2021 Mobile App Battle

Jan 27, 2021

The end of the year 2020 has also marked (optimistic) the end of the horrific chain of events that characterized it. ...

read more

iSeries at 10 Years: CIO Priorities in 2025

Jan 19, 2021

The first two decades were a bonanza for AS400 users as the modern applications were yet to be born & there was an abundance of programmers and developers showing deep interest in the machine. ...

read more

Monetize Through Mobile Apps in the Post Covid-19 Economy

Jan 19, 2021

As Covid-19 lockdown restrictions are being lifted, businesses are looking to grab their window of opportunity. ...

read more

Must Have Product Engineering Technologies of 2021

Jan 18, 2021

The COVID-19 pandemic has accelerated the digital transformation of organizations, and ISVs must rise to the occasion by upgrading their technologies and building better solutions. ...

read more

Stay Ahead in the Post Covid Economy with Mobile Apps

Jan 18, 2021

The world has been forced indoors by the ongoing pandemic. With 88% organizations requiring employees to work remotely and 97% business travel cancelled, work from home became the new normal. ...

read more

Elevate Your RPA Bot Integration and Delivery with CI/CD

Jan 07, 2021

Businesses around the world are increasingly employing RPA (Robotic Process Automation) tools to automate their processes, saving time and cost. ...

read more

Backup AS400: A Comprehensive AS400 Disaster Recover Plan

Jan 07, 2021

While your AS400 hosts all the mission-critical tasks, it lags in one essential feature of backup and recovery. ...

read more

Make AS400 Future Ready Now - Here's What You Need to Doo

Nov 30, 2020

If the two statements resonate with you, you ought to read on, as you might just hit the silver bullet to redeem your AS400 system....

read more

Cloud Services: Choose a True Partner, not a Vendor

Oct 15, 2020

The last few years have been a watershed in the revolution that reshaped the world’s perception of digital technology. Groundbreaking breakthroughs have pushed boundaries and made people see new possibilities in what were considered dead-ends. ...

read more

How to Use AS400 Modernization Tools to Facelift Your IBM i Systems in 2025

Oct 08, 2020

Ever since its arrival over three decades ago, IBM i/AS400 has been synonymous with performance and reliability. It’s not without reason that major corporations around the world continue to bet on it for hosting mission-critical tasks of their organizations. ...

read more

Automation Solutions for IBM i - What Can They Do?

Sep 23, 2020

RPA can enhance the functionality of IBM i and eliminate the need to invest time and effort in activities such as invoice processing, updating ERP, pulling email attachments, data entry, report pulling, data validation, etc. ...

read more

Transforming the Education Landscape with RPA

Aug 28, 2020

The education sector has never shown much enthusiasm to introduce technology to its traditional way of functioning. ...

read more

Worrying about the IBM i future? Here are some facts!

Aug 17, 2020

In the late 80s, the concept of enterprise systems was nascent and business leaders were in the dark about the implications of running operations with a disruptive system with tightly integrated hardware, software, security, and database. ...

read more

Repowering your iSeries/AS400 applications with cloud

Aug 04, 2020

Among the widely used enterprise applications in existence today, AS400 systems sit right on the top. With many large, small, and mid-sized enterprises still banking on the high-performance machine for hosting mission-critical tasks, IBM has been evolving the AS400 to match the rapidly evolving business needs...

read more

Maturity model - The silver bullet for the challenges facing ISVs

Apr 02, 2020

For sustainable growth, independent software vendors must be aware of their current status. A maturity model tailored to ISVs helps them with data-driven methodologies, tools, and frameworks for ranking themselves against the industry benchmarks. ...

read more

ISV Market Growth: Key Factors from 2020

Apr 01, 2020

With the market embracing new technological developments, 2020 promises to be a challenging but rewarding year for ISVs....

read more

RPA Revolutionizes Customer Service Response

Dec 19, 2019

A typical call center workflow comprises countless repetitive tasks that do not require intelligence or decision-making to be executed....

read more

Artificial Intelligence – Current and future trends

Nov 28, 2019

Artificial Intelligence (AI), the buzzword these days, has become an indispensable part of the modern world with a profound bearing on most human activities. ...

read more

Tips to choose the right processes for RPA

Nov 04, 2019

This statement perfectly underscores the need for a detailed analysis of processes before choosing them for Robotic Process Automation (RPA). ...

read more

AI and RPA join forces to deliver Intelligent Automation

Nov 04, 2019

High productivity, better efficiency, and low associated costs are a few striking advantages associated with smart Robotic Process Automation (RPA) implementation. To put it simply, RPA is the automation of tasks that are high-volume, repetitive, rule-based, use structural inputs, and don’t involve human judgment. ...

read more

PHP 5 to PHP 7 migration

Jul 22, 2019

PHP 7 has been launched with exciting features and drastic performance improvement. There is a drop in memory consumption and many fatal errors are converted to exceptions....

read more

Involvement of the IT Department in RPA Implementations

Jul 22, 2019

In any RPA project, apart from the development aspect, there are a high number of other tasks that need to be performed competently to ensure its success. Particularly during the project implementation phase, the IT department plays a crucial role by setting up the system for production....

read more

Does your Event Marketing platform cater to these?

Mar 29, 2019

Event management and marketing has become insanely data driven in the past few years. In fact, all facets of events, be it sponsorship, marketing or organization, providing rich content to attendees (or participants) will become extremely beneficial as this industry matures. Collecting and securely saving data is the key for fut...

read more

Intelligent RPA in Banks- Bet your bottom dollars

Mar 20, 2019

A slow economy, further stimulated by a do-more-with-less culture is compelling enterprises to introspect and devise methods to boost productivity. Financial functions are under significant pressure and within the BFSI sector, there is a continuous evolution due to high competition.Banks are under pressure toAll this lands us at...

read more

Vagrant: Building stronger workflows in DevOps

Mar 05, 2019

In my previous post, I spoke about DevOps in 2019, and the surge that is expected in DevOps practices across the Software Development LifeCycle (SDLC). From here on, we will be taking different DevOps tools and environments which are expected to contribute the most towards the DevOps tool market in 2019.Servers are moving faster...

read more

Latest trends in Event Management

Feb 26, 2019

Events are no longer seen as a cost component, but rather an opportunity to generate revenue, build brand awareness and long lasting relationships. This is a huge change in perspective, from a ‘white elephant’ to a ‘cash cow’, opening up doors for event marketing and management to bring in data sciences and prove their mettle.Br...

read more

RPA in Collections/Accounts Receivable (AR)

Feb 05, 2019

For all the hype that Robotic Process Automation (RPA) has created in the IT industry, its penetration leaves a lot to be desired. It has been studied that, the collections process (also known as Accounts Receivable or AR), despite being an excellent candidate for automation, has an RPA penetration of less than 15%!The first ste...

read more

DevOps in 2019: Tools & Best Practices

Jan 21, 2019

Improving the Software Development Lifecycle (SDLC) from design through development and production is essential for better applications and even better team performance. DevOps is a software engineering practice to improve the SDLC process from design through the development process to production support that unifies Software De...

read more

RPA BoTs in Shipping and Logistics: A SWOT Analysis

Jan 07, 2019

Tectonic shifts in technology are a major challenge for any organisation. One such technology is Robotic Process Automation, more commonly known as RPA. Automation is an entry point for future cognitive transformation opportunities, handling repetitive and rule based tasks without human intervention.Shipping and logistics manage...

read more

Does RPA kill jobs?

Dec 12, 2018

We are creatures of habit. We like our routines and are wary of change. When faced with the unknown, we often jump to conclusions, and most probably the worst of it. And, new technology has the unique capability to incite fear, a far and wide spread fear. Just take a look at the articles which come up for a generic RPA search &#...

read more

Entity Framework – What and Why?

Dec 03, 2018

Entity Framework is an open source object relational model framework for the applications built on .NET. It facilitates the developers to work with data without looking into underlying database tables and columns where the data is stored. With Entity Framework in place, developers can now create and maintain data-oriented applic...

read more

RPA in Warehouse Management

Nov 30, 2018

In today’s world, technology has been improved to a great extent, where many industries demand to be abreast with technology and its far reaching capabilities. A deep dive into warehouse management will show various processes, including sorting, packing, picking, storage, shipping, transportation, retrieval, etc., and in present...

read more

ServiceNow London Release: New Features to Look Out For

Oct 15, 2018

Each ServiceNow release offers some major breakthroughs in the service industry operations and delivery efficiencies. There has been many speculations on the upcoming ServiceNow London version (scheduled to release in 3rd quarter-2018).Here we better understand the capabilities set to release with ServiceNow London and how it wi...

read more

Manage IT Seamlessly with ServiceNow Development

Aug 03, 2018

Due to a huge gap in the marketplace for qualified consultants, early in 2018 Nalashaa made a business decision to work heavily in recruiting and placing Experienced ServiceNow Professionals. ServiceNow is “HOT” and customers, integrators and ServiceNow partners are all scrambling to find qualified employees....

read more

AI in Financial Analytics – The Machine Learning Engine

Aug 01, 2018

Cashflow planning, forecasting is done through state-of-the art algorithms and automated data discovery techniques that analyze your historical data, find patterns, outliers, anomalies, relationship between various variables.A machine learning driven engine gives you a precise vision on what will affect your Cash Flow position a...

read more

Artificial Intelligence in Financial Analytics

Jul 21, 2018

Successful businesses care for extensive cash flow planning. Mature finance teams follow best practices, to review everything on a regular basis to see what actually happened versus what they said would happen. Being aligned with your payment terms for payables and receivables, or planning your cash needs for the next quarter o...

read more

The Need for Speed in IT Recruiting

Jul 10, 2018

Is your IT recruitment in doldrums owing to a new power shift in job trends?If you believe you’re doing OK, think again. Hiring for information technology professionals has become more agile and strategic than ever before.Here’s why:According to U.S Department of Labor, employment in computer and information technology jobs will...

read more

Chatbots – The new frontier in Artificial Intelligence driven Sales

May 09, 2018

Imagine on a weekend, a customer decides to buy a laptop; he has made a list of all features and technical specifications required. Next, he visits your website to check prices, but its Saturday late evening and ends up at a Contact form telling “we will get back you soon”. The customer was in a mindset to buy the product but no...

read more

Artificial Intelligence for Event Management

Apr 13, 2018

Relying on computation for decision-making gives businesses a greater competitive edge. And, we have people talking about AI everywhere, from Elon Musk to Mark Zuckerberg.Event management is no exception and an AI experience will be expected by many. Following are the areas where Artificial Intelligence will play a major role in...

read more

Predictive and Preventive Maintenance

Apr 02, 2018

Predictive maintenance might sound like a buzzword but I have seen it in action. I can take the credit for implementing it and rendering it useful for end users.I spoke about predictive maintenance and how it can work across industries in a? webinar.Predicting unplanned failures can be beneficial to-Warranty CostWarranty cost ha...

read more

Asset Maintenance and System Reliability go Hand in Hand.

Mar 29, 2018

System reliability, uptime and downtime measures are core to industries such as manufacturing, oil and gas pipeline. Reliability measurement also plays an important role for consumer-oriented services such as gas stations, ATMs, and electric charging stations. Measuring these inter-related measures helps us check system’s health...

read more

Revenue Cycle Management: Effective Charge Capture using RPA

Mar 27, 2018

In the current phase where there are rapid changes in reimbursement methods, it is imperative that healthcare organizations capture every charge representing the care provided, and they bill correctly as per regulations.Unfortunately some RCM applications fail to identify missed charges and make the process of rectifying any lea...

read more

Automated Data Discovery – The Next Level in Business Intelligence

Mar 01, 2018

Many technology breakthroughs have taken place in last 10-15 years and have brought to the current stage where automated data discovery (ADD) is achievable and will soon become the regular way of conducting data profiling/data exploration exercises. There was a time when pulling data from Teradata or Brio to Excel, Minitab, perf...

read more

How can RPA help in Healthcare RCM?

Mar 01, 2018

Recent research shows that the healthcare RCM market is projected to grow to USD 65.2 billion by 2025. This growing market would need skilled workforce, which is already a scarce resource. With this tremendous projected growth, hiring and retaining top talent will pose to be a huge challenge.Unlike other automated approaches, Ro...

read more

Data security for GDPR and long-term RPA solutions

Feb 27, 2018

In my previous blogs, I spoke about GDPR and use cases where Robotic Process Automation (RPA) can provide some quick wins and help organizations work towards GDPR adherence without making extensive changes to their processes and LOB applications. In this blog, I will discuss areas where RPA can provide long-term compliance.With ...

read more

GDPR PII : RPA solutions to address new PII identifiers

Feb 20, 2018

In my previous blog, I introduced how RPA can address some of the mandatory obligations put in force by GDPR. Here, I take up the scope of GDPR personal identifiable information (PII) and how RPA can address some of the cases.GDPR increases the scope of personal identifiable information (PII) identifiers by including online iden...

read more

How can RPA address GDPR compliance needs?

Feb 13, 2018

General Data Protection Regulations (GDPR) will come into effect on May 25th, 2018 and it replaces the existing 1995 EU Data Protection Directive. GDPR applies to all organizations gathering, processing and storing personal data of European Union citizens regardless of the organization location. Data covered under GDPR includes any data that can be used to identify...

read more

The Bot Controversy – Scare or Care?

Jan 30, 2018

“The BOTS are coming! The BOTS are coming!The BOTS are coming to take your jobs!”It is always scary to read such stories! And what is even worse?Reading scary facts that thousands & millions will lose their jobs because of Robotic Process Automation (RPA) and further linking it to dooms day!“BOTS will Rule”There are always 2...

read more

Analytics and Trends Evolution in the Airline Industry

Jan 25, 2018

I always follow research efforts by MIT Center of Transportation. It is an easy way to know the problems that mature airline industry of North America is facing and attempting to solve. Another such department active in the field of airline industry was (and still is) the ISYE- Industrial and Systems Engineering department at ...

read more

RPA in Claim Processing reduces Claim Denials

Jan 15, 2018

Revenue Cycle Management (RCM) companies face numerous challenges, including claim denials and cost to collect. It is estimated that up to 40 percent of medical bills contain errors and a report by Advisory Board states that 90% of claim denials are preventable and can be corrected for payment. Claim denial management is a big o...

read more

Outliers – An important element in Business Intelligence

Jan 11, 2018

It’s always fascinating to observe outliers and understand them. Outliers are the data points that don’t seem to fit well with rest of the data population. It is interesting that data points with outlier behavior are ‘outlier’ but can be found in almost every dataset that you get your hands on. Identifying outliers is always one...

read more

Intelligent Solutions using Cloud Based AI Platforms

Jan 07, 2018

Artificial Intelligence (AI) and Machine Learning (ML) are two big buzzwords prevalent across the industries today. People, in particular developers are fascinated with this emergent technology, irrespective of their area of expertise. While a lot of them are still trying to figure out the nuances of AI and ML, the world has mov...

read more

OCR, ICR and RPA – The nuts and bolts

Dec 11, 2017

We spoke about Robotic Process Automation (RPA) and how bots can be used to speed up processes and remove unintentional errors which crop up during document management. The two techniques followed in the automation industry are OCR (Optical Character Recognition) and ICR (Intelligent Character Recognition), to read any type of d...

read more

Integrating Regex in Robotic Process Automation (RPA)

Nov 28, 2017

Regular Expression, REGEX, or regexp, sometimes called a rational expression, can be defined as a sequence of characters that form a search pattern.It’s like sorcery to a layman, something they don’t really comprehend, but want to make use of anyway, for it’s a very powerful tool, especially when used aptly and for the right pur...

read more

Robotics Process Automation – Revolutionizing IT Industry

Nov 14, 2017

Within IT organizations or any other industry, automation is the new entrant and is here to stay!Robotics Process Automation – giving way to Artificial Intelligence? A speedy approach? Or error free technology? Or Productivity?According to industry statistics, 30-40% of project costs are rework. Automation is a natural er...

read more

Image Recognition – The heart of sophisticated RPA

Oct 31, 2017

RPA platforms use IDs to identify the elements inside the target applications and then perform actions like mouse clicks or sending Hotkeys to get the desired end result. When we work with remote systems and databases, like Citrix or the open web, it is not easy for the robot to identify the selector regions on screen.In case of...

read more

Robotic Process Automation in Insurance Industry

Jul 11, 2017

(RPA) applies specific technologies to automate routine, standardized tasks in support of an enterprise’s knowledge workers. By freeing human employees from these mundane tasks to apply themselves to core business objectives, RPA offers a number of compelling benefits to the workplace. – Institute for Robotic Process Automation ...

read more

Predictive Analytics – Step 1 on the path to AI

Jun 08, 2017

Along with the emergence of new devices, we have data which is ever growing. And all this data is being collected for what?As someone correctly said – to analyze, see patterns and predict!And for all this data, you might think Artificial Intelligence (AI) to solve all data problems. And that is a good answer too.But, how d...

read more

BI & Analytics to Boost Retail Sales Performance

May 17, 2017

We have talked about Business Intelligence in Retail prior to this too, where we discussed how customer acquisition and analyzing customer data is key for a successful retail business. Now we will talk about how we can analyze sales and performance and use BI tools to help in decision making.BI is nothing but a tool which helps ...

read more

What is Digital in Mortgage?

Apr 24, 2017

Digital or Digitalization is an umbrella term for the services using digital technologies, mainly on the Internet, but also including mobile phones, display advertising, and any other digital medium.This is going to be a series of posts on digital mortgage, in the attempt to discuss and give a clear picture of what is the digita...

read more

How can BI help in adhering to insurance industry regulations?

Mar 27, 2017

Developing an adaptable strategy for regulatory challenges and adhering to industry regulations, along with a good ROI for each investment is a tough nut to crack.Every big insurance company has multiple portfolios which are managed by different managers. Each investment manager should adhere to 3 levels of regulatory compliance...

read more

The How and Why of Business Intelligence in Retail

Mar 06, 2017

The retail business involves the process of selling consumer goods or services to customers through multiple channels of distribution to earn profit. There are many challenges which these retailers face on an ongoing basis, where the primary two are – competition for customers and the expenses involved in running a retail...

read more

Sign and Zipalign APK Using Existing Keystore

Mar 02, 2017

Updating an app on Play store is something which is a routine task if you wish to optimize the app and increase usability for the users. When we try to publish an update for an existing app to play store we SHOULD use the existing key store file which we used while initially publishing the app on play store.While trying to achie...

read more

Robotic Process Automation (RPA) and Enhanced Customer Experience

Feb 21, 2017

In my last blog I talked about how, Robotic Process Automation leads to changing job roles and the effect it would have on employees and employers.Here, I take the opportunity to highlight the great multiplier effect a successful RPA implementation can have on customer experience.Whatever be the form of these journeys, all of us...

read more

Business Intelligence Needs of Insurers

Feb 18, 2017

The insurance industry has gone through many changes in the past few years. The interaction between insurers and customers has changed a great deal and strong competition is forcing insurers to take quick steps in building closer ties with their customers. There are many business intelligence tools out there which work great for...

read more

How To: Background jobs in Web Application using Hangfire

Feb 09, 2017

Don’t you not like it one bit when users think that your application is sluggish? And you know that, you really cannot do anything about it, because it is interacting with third party services, tools, vendors, and is just doing way too many tasks and some of them really complex.If you think, the user need not wait for the job to...

read more

Claim Analysis and fraud detection Using Business Intelligence

Feb 02, 2017

Fast and effective claim handling is the base for customer relationships in the insurance industry, but insurance companies also have to protect themselves from the fraud claims that they might be faced with time to time.A new study from the Insurance Research Council (IRC) estimates that claim fraud and buildup added between $5...

read more

RPA & the emergence of new job roles

Jan 30, 2017

A few months ago I had written about the impact of RPA on traditional back-office and rule based activities performed by humans.The disruptions look scary and have a massive impact in the short term. However, newer sectors of job roles opening up will make it more interesting for workers and will also help organizations run bett...

read more

Insurance Risk Management and Business Analytics

Jan 16, 2017

Insurance is a risk-transferring mechanism that ensures full or partial financial compensation for the loss or damage caused by event(s) beyond the control of the insured party. And in turn, risk management is very important for the insurance industry. Insurers consider every available quantifiable factor to develop profiles of ...

read more

Robotic Process Automation (RPA) and its impact

Nov 09, 2016

In my last blog I touched upon Intelligent Enterprise Automation broadly covering Machine Learning, Autonomics, Machine / Computer Vision and Natural Language Processing. Today, I will focus on Autonomics and its impact on business and IT to be more specific.Autonomics are intelligent systems that apply self-adapting policies to...

read more

Enterprise Intelligent Automation – coming of age

Oct 24, 2016

By 2019, the global market for content analytics, discovery and cognitive systems software is projected to reach $9.2 billion, according to IDC, more than double that of 2014.Intelligent automation is rapidly coming of age. “Smart” machines and “smart” systems and “smart” bots are becoming mainstream. Intelligent automation whic...

read more

From TRID to HMDA: Changes and Implementation

Jul 19, 2016

The mortgage industry is finally recovering from the TRID firestorm, where originators were dismayed with average time to close being 50 days. Profits were sinking like a big giant boulder recording as much as 60% reduction. Mortgage originators are now once again experiencing some positive headwinds. The average Time to Close is within a respectable range and profits are on the rise again, leading to many sighing breaths of much deserved relief but wait… here comes HMDA....

read more

Technology Impacts on the Financial Services Industry

Jul 11, 2016

Financial services sector has been mostly impervious to radical technical and business model changes. They have been able to maintain a relatively stable but profitable business models over the last few decades. Traditional businesses are now under siege from a whole host of innovators and technology changes that are forcing a re-think on the business models of the traditional financial services sector....

read more

Connecting the dots for an IoT scenario

Jun 15, 2016

Today IoT is a buzz word in the market. But, what is IOT- Internet of Things?Internet of things is all about collecting and managing massive amount of data from a rapidly growing network of devices and sensors, processing the data, and then sharing it with other connected things. Though we have already seen this in a limited sco...

read more

What is Column store index?

Mar 03, 2016

Column store index is a new feature in MS SQL server, initially introduced with MS SQL server 2012 but had some limitations. Those limitations have been removed in MS SQL server 2016.Column store index is designed to speed up analytical processing and data warehouse querying. As the name suggests, here data is stored column wise...

read more

Setting up CI Deployment Automation – Ansible | Blog

Feb 25, 2016

Recently, we did some great work on Continuous Delivery and thought we should share our learnings. We implemented the solution of Continuous Integration & Auto Deployment (Continuous Delivery) for a major Australian customer in retail & ecommerce space. The challenges we faced were to maintain several instances of the ...

read more

Custom Auto Deployment: A Client – Server Model

Jan 22, 2016

Auto deployment is extremely useful when installations need to be carried out at multiple locations in a quick and effective manner.One of our customers, one of the major ISVs in Behavioral health with over a hundred client installations, were handling many such installations manually. The process in place used deployment via r...

read more

Cloud and mobile revolutionizing the pharmaceutical industry

Jun 08, 2015

Compliance tracking, globalized clinical trials and outsourced vendors has made it almost mandatory for this industry to push aside the traditional outlook and get onto the technology bandwagon.Pharmaceutical regulatory compliance is primarily dependent on the management of the compliance process and thorough documentation to de...

read more

Insecure Direct Object References – Closing the doors

Mar 04, 2015

We have all worked on scenarios where we grant system object access to certain users based on the parameter, provided by them. Sometimes, the user just changes the parameter passed as input intelligently, and she gets access to some restricted documents or db data.For example, you should not be able to see your manager’s review ...

read more

Cross-site Scripting (XSS) - Focus on validation for web applications

Feb 20, 2015

As a part of this security series, I had posted previously about SQL injection, and how this simple concept can manifest itself into a major security concern. This blog post will focus on validation of input and output in a web application.In web-application it has been noticed that we validate the input most of the time. This ...

read more

SQL Injection Explained: A Simple Security Risk

Jan 27, 2015

In my previous blog, I focused on the security issues associated with broken authentication and session management concerns. Here I shall focus on the security and the vulnerability quotient of an application.I will discuss about the threats and their possible solutions. I will also mention few tools that aid the hacker in outs...

read more

Strategies for Web Application Performance Optimization

Jan 23, 2015

Know yourself and know your enemies, use you ammunition to annihilate the enemies. So before going for a war, first figure out whether you have enemies (performance issues). Is your application not meeting the performance benchmark? There is always scope of improvement, albeit in diminishing returns, so your performance work wou...

read more

Secure Software Product Engineering | Nalashaa Services

Dec 19, 2014

This blog post showcases the need for protecting user’s password, the password habits that the application should enforce to the end user, and the practices that a developer should follow to secure a user’s information, especially the session information. This blog will also focus on aspects of session management.Some key ...

read more

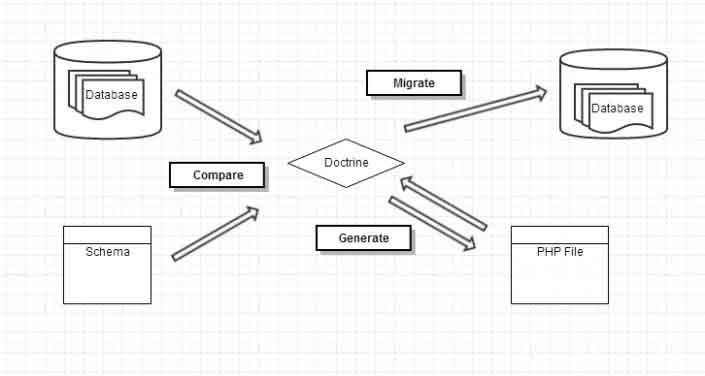

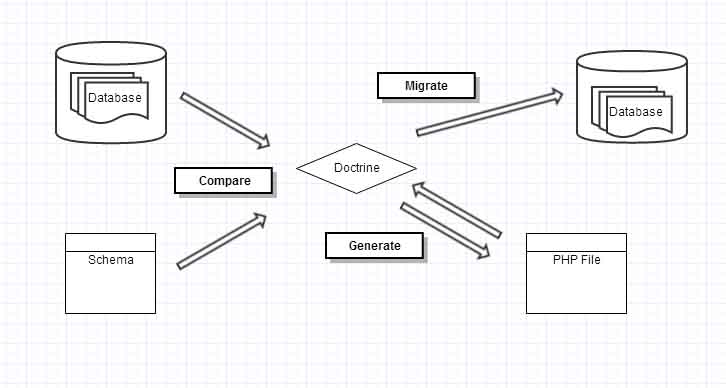

Doctrine Migration – Part 2

Sep 02, 2014

Doctrine migration has been used by me many times, and there are some small changes which affect the process, and some others which help us to use the migration process better. Part 1 of the Doctrine migration series depicted how to go about a migration set up. Now, I shall go about explaining in a step by step manner how to go...

read more

Network security, a change in approach for the cloud

Aug 28, 2014