Fraud has many shapes and forms, such as credit card fraud, investment fraud, insurance fraud, and so on. It affects businesses and government organizations in almost irreparable ways, resulting in financial loss and damage to reputation, among other things. Due to increasing rates of fraud, fraud detection has become an integral part of every large organization.

Why is Fraud Detection Important?

One of the key aspects of effective fraud detection is the use of data. Analyzing large amounts of data in datasets such as transaction data, customer data, and behavioral data, companies can provide valuable insights into a company's operations, helping to identify fraudulent activities and mitigate potential risks.

To combat fraud, businesses need to implement effective strategies that can help detect fraudulent activities before they cause significant damage.

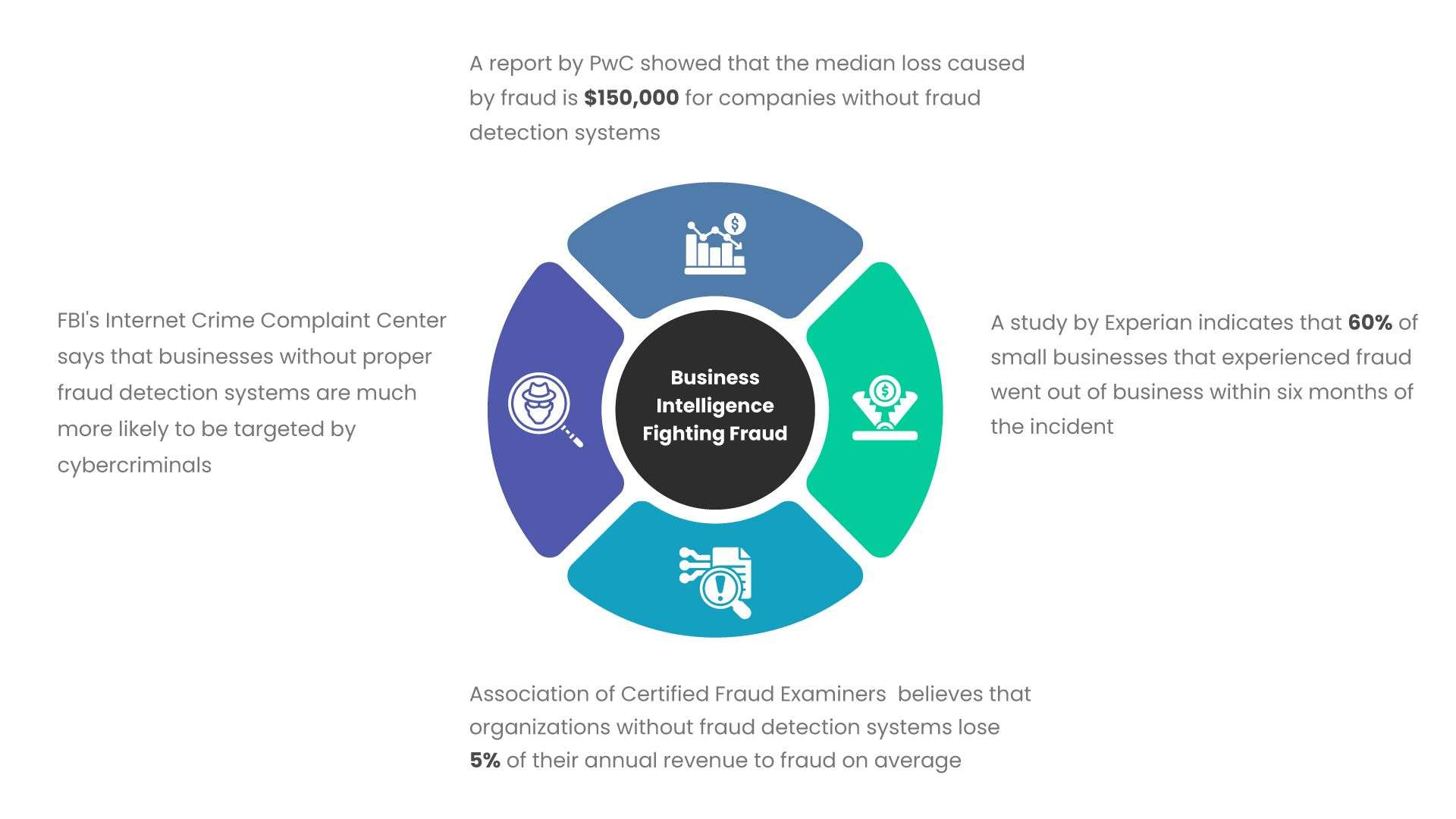

One effective approach to fraud detection is using Business Intelligence (BI) services. BI tools can help uncover fraudulent activities by utilizing data visualization, machine learning algorithms, and real-time monitoring.

Using Data Visualization to Identify Fraudulent Patterns

With this highly effective BI tool, businesses can identify patterns and trends that indicate fraudulent activities. Businesses can also create interactive dashboards that can display data in real-time. By doing so, it can help finance teams monitor and analyze their data in real-time, identify suspicious activities, and closely monitor key performance indicators (KPIs) to detect unusual patterns that may indicate fraud.

Leveraging Machine Learning for Fraud Detection

Machine Learning (ML) algorithms play a critical role fraud detection. These algorithms make use of advanced statistical models and predictive analytics to identify and anticipate fraudulent activities in real-time. Business Intelligence (BI) software services help in streamlining the implementation of these algorithms, resulting in a more efficient fraud detection system.

Additionally, BI software also offers the ability to handle vast amounts of data, allowing organizations to work with larger data sets and more sophisticated models such as deep learning neural networks, decision trees, and Support Vector Machines (SVM). With these tools, businesses can optimize their fraud detection capabilities, stay ahead of potential risks, and ultimately protect their financial assets and reputation.

The Benefits of Real-time Fraud Detection using BI

Real-time fraud detection is an effective way for businesses to minimize financial loss and risk damage to their reputation. By using BI tools like IBM Cognos and SAP Lumira to create real-time fraud detection dashboards and reports, the business can receive alerts and notifications about suspicious activities, allowing them to take immediate action. This can help prevent further financial loss and protect a company's reputation.

Conclusion

Business intelligence has a significant impact on both – detection, as well as prevention of fraud. However, it is important to remember that a solid internal system of policies and procedures must be the basis for BI implementation. Continuous monitoring and updating of internal controls and policies is also critical to ensure that ongoing efforts towards fraud detection and prevention are successful.

Why Nalashaa is the Ideal Business Intelligence Service Provider

Nalashaa is a leading provider of Business Intelligence services. Our experienced data wizards have the expertise necessary to help businesses increase operational efficiency, improve decision-making, and drive growth. We offer tailored solutions, including standalone and packaged BI services, to meet the specific needs of our clients

Get in touch with us today, and start using data in a smarter way!