From the surge in online shopping to rising customer expectations for instant service, retailers face intense pressure to work smarter and more efficiently. Robotic Process Automation (RPA) is emerging as a game-changer in this space. RPA in retail means using software “bots” to automate repetitive, rule-based tasks, everything from updating spreadsheets to responding to customer inquiries. By letting bots handle the boring and time-consuming work, your human team can focus on higher-value activities like improving the customer experience or strategizing growth.

It’s no wonder companies are investing in automation. In fact, the global RPA market is expected to approach $10 billion by 2025, with retail and e-commerce accounting for a large share of that growth. And with worldwide e-commerce revenue projected to hit $4.32 trillion in 2025, retailers need tools like RPA to keep up with demand.

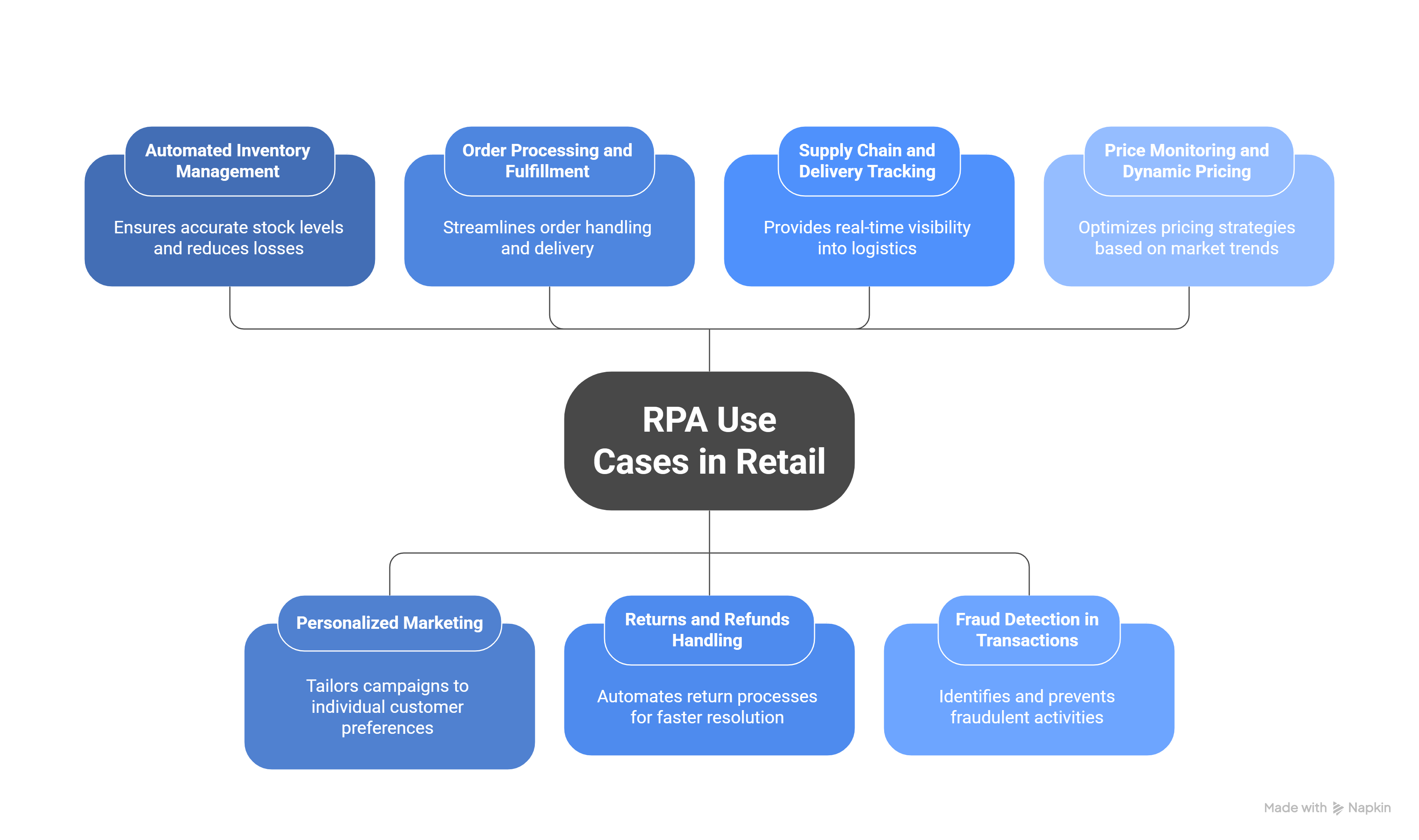

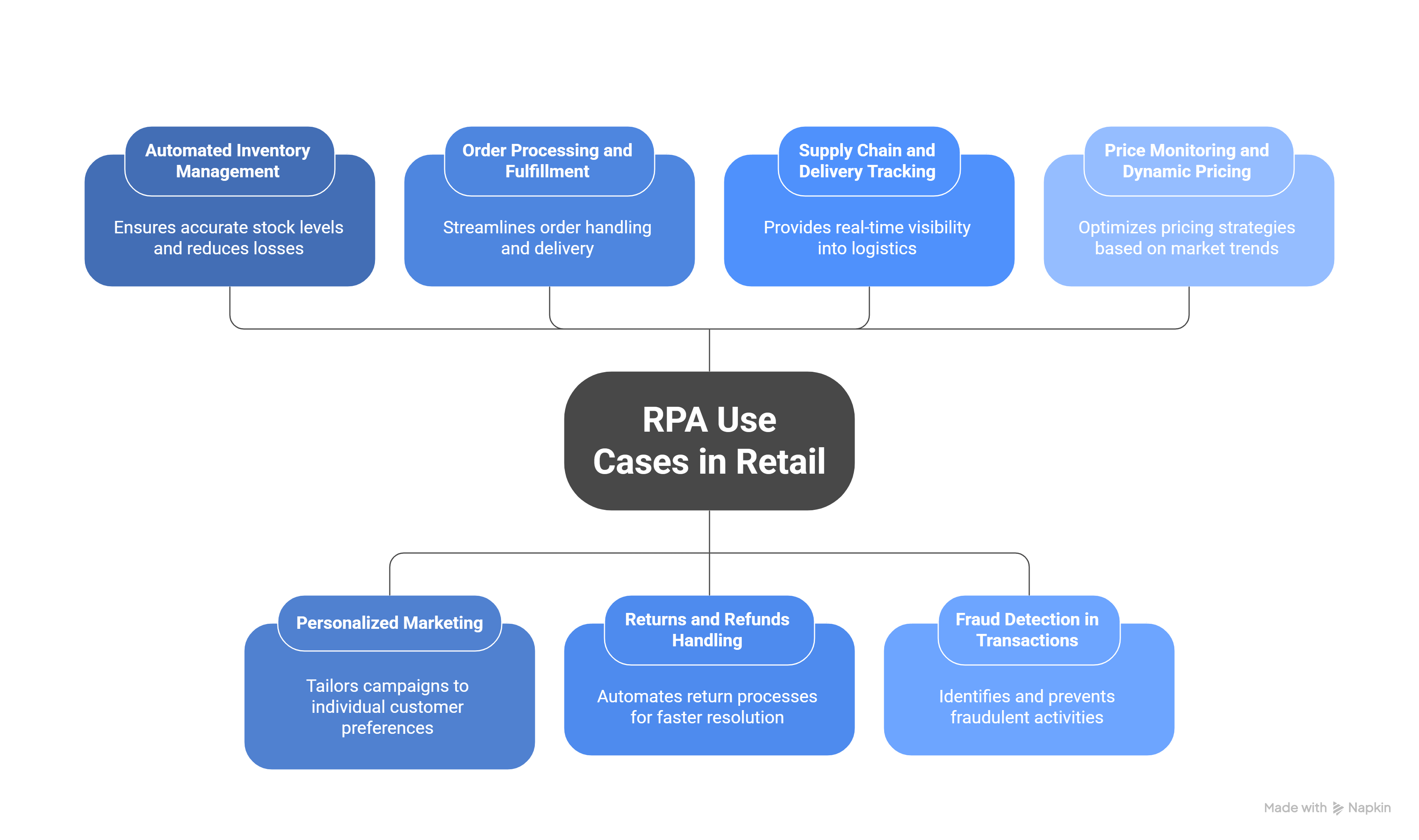

Whether you’re a retail business owner, a tech leader, or a beginner curious about automation, this blog helps you. Let’s explore 10 key use cases of RPA in retail and what pain points each one can solve in day-to-day operations.

Top 10 RPA Use Cases in Retail (and the Problems They Solve)

Below are ten practical RPA use cases in the retail industry. For each, we’ll highlight the typical challenge or pain point retailers face and how an RPA solution can help.

Automated Inventory Management

When I started digging deeper into retail automation and speaking with a few operations teams, one thing became clear very quickly. Inventory is almost never as under control as it looks on dashboards.

On paper, stock levels appear stable. In reality, popular items go out of stock without warning, while slow-moving products quietly pile up in warehouses. This is not just a process inconvenience. It is expensive.

What retailers are really losing due to inventory gaps

- Globally, retailers lose close to $1 trillion every year due to stockouts

- 91% of shoppers abandon a purchase instead of waiting for restocks

- Around 87% of brands lose repeat customers because of poor stock availability

Once a customer hits a stockout a few times, trust erodes quickly. Loyalty does not disappear overnight, but it weakens with every missed expectation.

A big reason behind this is how inventory is still managed in many organizations. Manual counts, delayed reconciliations, and periodic checks are far more common than most teams like to admit.

Where manual inventory tracking breaks down

- Manual inventory tracking typically has error rates of 2.5% or more per order line

- Errors often occur during picking, receiving, or stock transfers

- Over time, these discrepancies become normalized rather than corrected

At the other end of the spectrum, overstocking introduces a different kind of damage.

The hidden cost of excess inventory

- Excess inventory carries 20 to 30% annual holding costs

- Storage, insurance, handling, and shrinkage quietly eat into margins

- Capital tied up in unsold stock reduces flexibility across the business

This is where RPA starts to feel less like a technology upgrade and more like a practical necessity.

Instead of inventory updates depending on end-of-day or end-of-week reconciliations, bots keep inventory synchronized in real time. Every sale, return, and stock movement updates systems automatically. When predefined thresholds are reached, reorders can be triggered without waiting for manual intervention.

What changes once RPA is introduced

- Stockouts typically reduce by 18 to 25%, especially in fast-moving categories like fashion and grocery

- Overstocking drops by around 15%, driven by real-time visibility

- Inventory accuracy improves as bots continuously cross-check POS, ERP, and warehouse systems

There is also a clear operational upside. RPA removes a significant amount of manual reconciliation work and reduces the need for frequent audits. Employees spend less time fixing mismatches and more time on higher-value tasks.

Many retailers report 30 to 200% ROI within the first year of using RPA for inventory-related processes. Around 86% of teams see measurable productivity gains, largely because inventory stops being a constant source of firefighting.

When inventory data becomes reliable and timely, decision-making improves naturally. Stock feels predictable again, not because demand is simpler, but because the system keeping track of it finally moves at the same pace as the business.

Personalized Marketing

When I started reading more about retail marketing and speaking to teams, one theme kept coming up. Almost every retailer wants to personalize their marketing, but very few feel confident that they are actually doing it well.

What usually gets in the way is not intent, but fragmentation. Customer data lives in too many places. Purchase history sits in one system. Browsing behavior in another. Email tools, ad platforms, and loyalty systems all hold pieces of the same customer story. Pulling this together manually takes time, so segmentation often gets reduced to the simplest options available.

How segmentation usually breaks down

- Customers are grouped by age, location, or broad buying categories

- Behavioral signals are ignored because they are hard to assemble manually

- Campaigns are sent based on static lists rather than real actions

This kind of shallow segmentation does not really move the needle anymore. Research shows that 87% of businesses lose nearly 64% of potential revenue because they rely on basic demographic segmentation instead of behavior-driven insights. It also explains why generic email campaigns struggle, with open rates typically stuck between 13 and 17%.

Customers feel the disconnect almost immediately. Messaging that does not reflect their interests or recent activity comes across as noise. In fact, 91% of shoppers say they abandon retailers after poor or irrelevant experiences, even when the product itself is not the issue.

This is where RPA starts to feel less like a marketing tool and more like a cleanup crew working quietly behind the scenes.

Instead of marketers manually pulling reports from Shopify, Klaviyo, ad platforms, and CRM systems, bots aggregate this data continuously. Purchase patterns, browsing behavior, brand preferences, and engagement signals are stitched together in near real time, without someone spending hours preparing lists or exports.

Once that foundation is in place, personalization stops being slow and reactive and starts feeling natural.

What changes when RPA supports personalization

- Emails and offers are triggered by real customer behavior, not outdated segments

- Browsing a category repeatedly can automatically prompt a relevant follow-up

- Frequent buyers of a brand can receive targeted discounts without manual setup

The impact of this shift is hard to ignore. Personalized emails see 26% to 82% higher open rates and generate 41% more clicks compared to generic campaigns. Beyond engagement metrics, the emotional response matters just as much. Around 70% of shoppers say personalized experiences make them feel valued, which directly affects trust and loyalty.

What retailers see in practice

- 46% higher customer spending driven by relevant offers

- Up to 400% ROI from personalization initiatives

- 60% of consumers become repeat buyers after a personalized experience

- Customer lifetime value increases by roughly 33%

What makes RPA especially valuable here is scale. Teams do not need to grow just to keep up with personalization demands. Bots handle the data movement, segmentation logic, and triggers quietly in the background. That is why many retailers see 30 to 200% ROI from RPA in marketing workflows and why 86% of users report productivity gains.

Marketing teams spend less time wrestling with data and more time focusing on what actually matters: messaging, timing, and creative strategy. Personalization stops feeling like an aspirational goal and starts functioning as part of everyday marketing execution.

Interested in learning how RPA fits into logistics workflows? Explore 7 automation use cases here.

Order Processing and Fulfillment

When you look closely at retail operations, order processing is one of those areas that feels manageable most of the year and then completely unravels during peak periods. Everything works fine until a sale goes live, demand spikes, and suddenly teams are juggling hundreds or thousands of orders coming in at once.

What kept coming up while reading and speaking to retail teams is how many order workflows are still stitched together manually. Someone checks the order, enters details into the ERP, updates inventory, coordinates shipping, and sends customer notifications. Each step depends on the previous one being done correctly.

Why manual order workflows struggle under pressure

- Every step relies on human intervention and timing

- Errors compound when volumes increase

- Delays in one system ripple across inventory, shipping, and customer updates

During high-volume days, that dependency becomes a real problem. It is not surprising that retailers are now planning to automate nearly 70% of daily store and order-related tasks by 2025. Manual handling simply does not hold up at scale.

Studies show that around 40% of un-automated processes introduce inconsistencies because of human intervention. When volumes surge, those small inconsistencies turn into visible failures.

What teams see during peak seasons

- Wrong items shipped

- Delayed dispatches

- Missing or late customer confirmations

For the 60 to 65% of retail operations still relying heavily on manual steps, peak seasons amplify every weakness in the process.

This is where RPA starts to change the dynamics quietly but decisively.

Instead of orders waiting in queues, bots pick them up instantly. Order details are captured directly from e-commerce platforms or emails, validated against predefined rules, and pushed into ERP and order management systems without re-entry. Inventory updates happen immediately. Shipping labels are generated automatically. Payments are cross-checked before anything moves forward.

What automation improves immediately

- Order capture happens in seconds, not minutes

- Inventory stays in sync without manual updates

- Shipping and payment checks run in parallel, not sequence

What stood out during research is how dramatically this reduces error rates. Automated workflows cut data entry mistakes, inventory mismatches, and shipping errors, pushing accuracy close to near-perfect levels. Fewer errors also mean fewer returns caused by fulfillment issues, which directly affects customer trust.

This growing focus on reliability explains why the retail automation market is projected to reach $64 billion by 2032. Speed matters, but consistency matters even more.

There is also a clear efficiency gain. RPA scales automatically during sales spikes, handling orders in seconds without overstaffing or burning out teams. By 2025, nearly 50% of inventory checks are expected to shift to automation, easing pressure on ERP workflows and removing repetitive coordination work from employees’ plates.

With integrations extending into IoT and real-time tracking systems, order visibility improves without adding operational complexity.

The biggest shift, however, is not just speed. It is predictability.

Orders keep moving even when volumes explode. Teams stop firefighting fulfillment issues and start trusting the process. And customers receive faster, more consistent deliveries, which is ultimately what keeps them coming back.

Interested in learning how RPA helps HR teams reduce manual work and focus on people? Visit this page to explore high-impact HR automation use cases.

Returns and Refunds Handling

Returns are one of those parts of retail that everyone accepts as unavoidable, but very few feel comfortable about. Things usually run fine until volumes spike. Then the cracks start to show.

Post-holiday periods are the clearest example. Returns flood in, tickets pile up, and teams suddenly find themselves juggling verification, stock updates, and refund requests across multiple systems.

Why returns overwhelm teams so quickly

- In the US alone, retail returns now exceed $800 billion annually

- In e-commerce, nearly 30% of orders are returned, compared to 8 to 10% in physical stores

- The volume difference alone is enough to break manual workflows

What makes this process especially painful is the amount of checking involved. Staff have to confirm purchase dates, verify product conditions, apply policy rules such as 30-day windows, and cross-reference ERP, POS, and payment systems. When all of this is handled manually, delays are almost guaranteed.

Refunds that should take hours slip into days. Customers notice. Around 70% of shoppers report frustration when refunds are not resolved quickly, particularly when they expect same-day responses.

Manual handling also introduces errors that quietly compound.

Where manual returns processing breaks down

- Eligibility checks and inventory updates show 15 to 20% error rates

- Fragmented data across emails, e-commerce platforms, and internal systems causes confusion

- Nearly 25% of returns end up disputed due to inconsistent policy application or missing information

Each disputed return ties up support teams for hours. Processing costs climb steadily, often reaching 5 to 10% of total retail revenue, without adding any real customer value.

This is where RPA starts to change the experience for both customers and internal teams.

Instead of return requests sitting in queues, bots validate them instantly against predefined rules. Purchase history, return windows, and product conditions are checked automatically. Inventory updates happen the moment an item is approved, and refunds are triggered directly through payment gateways without manual handoffs.

What changes once returns are automated

- Processing times improve by 80 to 90%

- Accuracy levels rise to around 99%

- Manual effort drops by roughly 70%, even during peak periods

Customers receive confirmations and refunds in seconds rather than days. That shift alone explains why many retailers report up to 40% higher satisfaction scores after automating returns.

What really stands out is how quickly the impact becomes visible. Because returns are such a high-volume, high-friction process, improvements show up within months. Inventory is restored faster, refunds stop becoming a source of tension, and support teams finally regain the capacity to focus on real customer issues instead of repetitive policy checks.

Supply Chain and Delivery Tracking

If you spend any time speaking with retail operations or supply chain teams, one pattern becomes obvious very quickly. Most of the effort is not spent fixing problems. It is spent trying to figure out where things actually are.

Modern retail supply chains stretch across manufacturers, warehouses, customs checkpoints, distributors, and multiple carriers, each operating on its own systems and timelines. Visibility is fragmented from the start. Teams jump between carrier portals, update spreadsheets manually, and make follow-up calls just to assemble a basic status update.

This approach works when volumes are low and nothing goes wrong. The moment complexity increases, the gaps start showing.

Where manual tracking starts to fail

- Shipment status lives across too many disconnected systems

- Updates depend on people checking portals and spreadsheets

- Delays surface only after they cause downstream issues

Studies consistently show that when tracking is handled manually across fragmented systems, 20 to 30% of shipment delays go unnoticed until they have already triggered problems elsewhere. Shelves go empty without warning, replenishment plans fail silently, and customers start asking questions before internal teams even realize something is wrong.

These missed signals cost retailers billions each year. The pressure intensifies during peak seasons, when supplier communication spikes and tracking spreadsheets become impossible to manage at scale.

What makes this even harder is that most supply chain issues are not dramatic failures. They are small disruptions that compound over time.

The kinds of delays that slip through unnoticed

- A customs hold that pushes delivery by a day

- A delayed pickup that breaks replenishment timelines

- A routing change that quietly affects downstream inventory

When these disruptions are tracked manually, they often remain invisible for days. This contributes directly to 15 to 25% fulfillment failures and ongoing inventory discrepancies. For retail operations that still rely heavily on manual checks, the lack of real-time visibility affects close to 60% of daily supply chain decision making.

This is where RPA changes the experience in a very practical way.

Instead of people chasing updates, bots continuously pull tracking data directly from logistics partners and carriers. That information is consolidated into a single operational view and fed into inventory systems and ERP platforms in real time. Shipment status and stock availability finally reflect what is actually happening on the ground.

What improves once RPA is in place

- Delays are detected immediately instead of days later

- Inventory systems stay aligned with live shipment data

- Customer service teams have accurate answers when customers call

When something goes off track, whether it is a customs delay or a missed delivery window, alerts are generated instantly. Operations managers see issues early, decisions are made with confidence, and manual coordination drops sharply.

Retailers typically reduce tracking and follow-up effort by 70 to 80%, while overall supply chain efficiency improves by 30 to 50%, simply because visibility no longer collapses under scale.

What changes most after automation is not just speed, but control.

Teams stop reacting after problems escalate and start addressing disruptions while there is still time to respond. Supply chain tracking stops being a daily source of stress and becomes a reliable operational backbone, even when volumes surge or networks grow more complex.

Interested in learning how RPA supports finance and accounting operations? Explore this page to see common automation areas and real workflows.

Fraud Detection in Transactions

Fraud is one of those problems that rarely announces itself clearly. Most of the time, it blends into normal transaction volume and only becomes visible once the damage is already done.

In e-commerce especially, the scale alone makes manual fraud detection unrealistic. Retailers in the US lose around $48 billion every year to e-commerce fraud, and nearly 30% of transactions show some form of anomaly, whether that is unusual purchase behavior, fake return attempts, or account takeovers. Yet despite this scale, most manual review processes cover less than 5% of total orders, simply because there are not enough hours or people to look at everything closely.

That gap matters.

What slips through manual fraud reviews

- 15 to 20% of fraudulent activity goes undetected

- Chargebacks quietly consume 1 to 2% of annual revenue

- Losses surface only after fulfillment, refunds, or disputes

What makes this situation worse is how fraud reviews are typically handled. Large orders from new buyers, billing and shipping mismatches, or unusual purchasing velocity all require careful inspection, often across multiple systems.

Payment gateways, ERPs, order management platforms, and customer records rarely sit in one place. Reviewing a single suspicious case can take hours, and when teams are fatigued or under pressure, error rates climb to 10 to 15%, even among experienced reviewers. Disputes become common, particularly with fake return claims, where nearly 25% of cases end up contested, tying up support teams and inflating operational costs well beyond the value of the fraud itself.

Why fraud escalates during high-volume periods

- Higher order volumes increase anomaly counts

- Less time is available per transaction

- Manual reviews miss patterns that only appear at scale

When customers are affected, trust erodes quickly. Around 70% of shoppers say fraud incidents or account issues damage their confidence in a retailer, even when the issue is eventually resolved.

This is where RPA begins to shift fraud detection from reactive to controlled.

Instead of relying on spot checks, bots continuously monitor transactions as they happen. Patterns that indicate risk, such as velocity spikes, geographic inconsistencies, repeated payment attempts, or abnormal order behavior, are flagged instantly.

What changes with RPA-driven monitoring

- 80 to 90% of risky transactions are routed automatically for action

- Clear false positives are filtered out, reducing noise by up to 70%

- Human reviewers focus only on true edge cases

When combined with analytics, this approach reaches accuracy levels close to 99%, not because bots replace judgment, but because they narrow the problem space. Fraud is intercepted earlier, chargebacks drop, and investigations move faster without overwhelming teams.

Retailers adopting RPA-driven fraud detection often see returns within months, with ROI figures around 40%, largely because losses are prevented rather than recovered after the fact. More importantly, customer confidence improves. Legitimate shoppers experience fewer disruptions, and security stops being a constant source of anxiety for operations teams.

Fraud will never disappear entirely. But with the right automation in place, it becomes manageable.

Instead of chasing problems after they surface, retailers gain the ability to spot risks early, act decisively, and protect both revenue and reputation without burning out the people responsible for doing so.

Price Monitoring and Dynamic Pricing

Pricing is one of those areas where most retailers know they are exposed, even if they do not always talk about it openly. The market moves fast, competitors adjust prices constantly, and yet many pricing teams are still working with tools and processes that were never designed for this pace.

When you look closely at how pricing is handled in many organizations, it often comes down to manual checks. Someone opens competitor websites, scans a few key products, updates a spreadsheet, and tries to draw conclusions from a partial snapshot.

Why manual price monitoring falls apart

- Tracking competitor pricing consumes 20 to 30 hours every week

- Even with that effort, teams miss nearly 70% of price changes

- Monitoring thousands of SKUs in real time is simply not humanly possible

The consequences rarely show up immediately. They surface quietly over time.

Products end up overpriced without anyone noticing, leading to 10 to 15% of carts being abandoned as shoppers compare prices elsewhere. In other cases, teams react late and drop prices aggressively just to stay competitive, which slowly eats away 5 to 8% of margins every year.

What makes this harder is the quality of the data driving those decisions. When pricing updates are based on incomplete or outdated information, response times lag. That is why nearly 60% of retailers trail their competitors by days when reacting to price movements.

Where competitive pressure hits hardest

- Large players adjust prices multiple times a day

- Mid-sized retailers struggle to keep up with rapid changes

- Market share losses of up to 25% occur simply due to slow reactions

Pricing managers often end up spending more time watching competitors than thinking strategically about pricing, promotions, or margin protection.

RPA changes this dynamic by taking over the surveillance work entirely.

Bots monitor competitor pricing continuously, either by scraping websites or pulling data through APIs at defined intervals. Instead of working from static snapshots, pricing teams operate with live comparisons that reflect what is actually happening in the market.

What changes once pricing surveillance is automated

- Competitor price drops are detected immediately

- Alerts trigger instantly, or prices adjust automatically within approved rules

- Manual monitoring effort drops by around 80%

This does not mean teams stop caring about pricing. It means they stop chasing data. Decisions become faster, calmer, and more consistent.

Retailers using RPA-driven pricing workflows often see margin improvements of 12 to 20%, simply because pricing actions are timely rather than reactive. Productivity gains reach 86%, and pricing strategies scale across thousands of SKUs without adding analysts or exhausting existing teams.

Response times improve by 30 to 50%, allowing retailers to stay competitive even during rapid market shifts.

What really changes is how pricing feels internally.

It stops being a constant race against the clock and becomes a controlled, data-backed process. Teams focus on strategy rather than surveillance, margins stabilize, and pricing decisions finally move at the same speed as the retail market itself.

Sales Analytics and Demand Forecasting

One thing that becomes obvious very quickly when you look at how retailers use data is that the problem is rarely lack of information. It is timing.

Sales data sits everywhere. Point-of-sale systems, e-commerce platforms, CRM tools, marketing dashboards, footfall trackers. Every system captures something useful, but pulling it together manually takes time. By the time reports are compiled, checked, and shared, the moment they describe has already passed.

Why manual reporting falls behind reality

- Sales data is spread across too many systems

- Reports take days to prepare and validate

- For nearly 80% of retail decisions, reports are already outdated when reviewed

This delay has real consequences. Monthly or even weekly summaries gloss over what actually matters, which is how demand shifts within days or even hours. Retailers miss early signals that a product is gaining traction or slowing down.

What gets missed when timing is off

- 20 to 30% excess inventory waste in some categories

- Stockouts elsewhere contributing to over $1.1 trillion in global losses annually

- Staffing and promotion decisions based on incomplete performance views

Forecasting becomes especially difficult under these conditions. Without automation, identifying patterns often comes down to educated guesswork. Seasonal demand, weather-driven spikes, or event-based surges are noticed only after they have already played out.

Where forecasting accuracy breaks down

- Forecast errors of 15 to 25% are common

- Teams spend nearly 40% of their time pulling and cleaning data

- Analysis and decision-making get delayed

This lag makes retailers reactive rather than proactive. Over time, it quietly erodes margins by 5 to 10%, particularly in fast-moving or volatile markets.

This is where RPA changes the pace of decision-making.

Instead of waiting for reports to be assembled, bots continuously pull data from POS systems, online stores, and CRM platforms and consolidate it into live dashboards. Sales performance, product movement, and channel trends update automatically, without someone having to request or prepare a report.

What improves once dashboards update in real time

- Performance trends surface while they are still actionable

- Channel and product data stays synchronized

- Teams stop waiting for scheduled reports

When combined with AI, these dashboards move beyond reporting into forecasting. Patterns start to surface early. A sudden lift in demand tied to weather changes. A category picking up momentum mid-week instead of over the weekend.

RPA-driven analytics can reach forecast accuracy levels of 85 to 95%, while reducing report preparation time by up to 90%.

How decision-making changes in practice

- Fast-moving items are reordered immediately

- Promotions are adjusted while they are still live

- Slow sellers are marked down before becoming dead stock

Retailers using this approach often see 15 to 25% sales uplift, simply because decisions are made while opportunities still exist.

Over time, sales analytics stops feeling like a reporting obligation and starts functioning as an operational guide. Waste goes down, responsiveness improves, and teams spend more time acting on insights instead of chasing data.

Product Categorization and Data Entry

Product data tends to look simple on the surface. Anyone who has worked with a growing retail catalog knows how quickly that assumption falls apart. Every new product needs to be classified, tagged, and entered correctly across internal systems, websites, and third-party marketplaces. As catalogs grow into the thousands, this quietly becomes one of the biggest operational drains in retail.

Manual entry slows everything down almost immediately.

Retailers onboarding large volumes of SKUs often see product setup timelines stretch by up to 70%, simply because every attribute has to be checked, typed, and verified by hand. Fatigue sets in fast, and with it come mistakes.

Where manual product data starts breaking down

- Misclassification rates of 10 to 20% are common

- Attributes like size, color, or brand are mislabeled in 12 to 18% of entries

- Inconsistencies creep in across systems and channels

When this happens, the impact ripples outward. Search results suffer, inventory visibility weakens, and analytics built on that data become unreliable.

Customers feel this almost immediately.

How poor product data affects the buying experience

- Fragmented categorization makes products harder to find

- Search and filtering accuracy drops

- Cart abandonment increases by 15 to 25%

On the backend, inaccurate product data skews inventory tracking and demand forecasts by up to 20%, leading to poor replenishment decisions. Things become even more complicated when vendor data arrives in unstructured formats like emails or PDFs. Teams spend hours reworking feeds before products can even go live.

This is where RPA brings structure and consistency back into the process.

Instead of relying on manual interpretation, bots ingest product data directly from spreadsheets, vendor feeds, emails, or PDFs, using OCR where needed. Classification rules are applied automatically, ensuring products land in the correct category every time.

A sneaker, for example, is consistently placed under “Shoes > Athletics” with all the correct attributes attached, regardless of source format or volume.

What changes once categorization is automated

- Categorization accuracy reaches around 99%

- Data entry time drops by 80 to 90%

- Bulk updates process in near real time

The catalog stays clean, standardized, and synchronized across channels, without compounding errors from manual repetition.

The downstream benefits are significant. Search relevance improves, product discovery becomes smoother, and returns caused by mismatched descriptions or attributes decline. Analytics and forecasting also become far more reliable because they are built on consistent, trustworthy data.

Retailers using this approach often see 30 to 40% efficiency gains, not because teams work harder, but because they stop fixing avoidable data problems.

As catalogs continue to expand and omnichannel selling becomes the norm, clean product data is no longer a nice-to-have. RPA allows retailers to scale their catalogs confidently, without sacrificing accuracy or customer experience, and without turning product management into a bottleneck that slows the entire business down.

Customer Support Automation

Customer support is one of those areas where the pressure never really drops. Retail teams deal with a steady stream of questions every single day, and most of them are the same. Order status. Return policies. Address changes. Refund timelines. Individually, these questions are simple. At scale, they become overwhelming.

In many retail operations, 60 to 70% of support agents’ time is spent responding to routine queries. Customers expect answers almost immediately, often within seconds, yet manual handling rarely keeps up.

Why traditional support models struggle

- Customers expect near-instant responses

- Around 80% of shoppers cite long wait times as their biggest frustration

- Queries arriving late nights or weekends degrade the experience further

For smaller retailers, the problem is magnified. Staffing a support team around the clock can increase costs by up to 40%, which is simply not sustainable for many businesses.

Delays also compound internally.

Where manual support starts breaking down

- Agents spend time switching between disconnected systems

- Response times increase during sales peaks

- Error rates climb to 15 to 20% under pressure

Customers lose patience quickly. Nearly half of unresolved chats are abandoned, and satisfaction scores take a hit that directly affects repeat purchases and long-term loyalty.

This is where RPA-powered customer support changes the dynamic.

Instead of relying on scripted replies or manual lookups, chatbots integrated with RPA pull real-time data directly from shipping systems, order databases, and return workflows. When a customer asks about an order, the response includes live tracking information. When someone wants to initiate a return, eligibility is verified automatically, a return label is generated, and the process is guided end to end without human involvement.

What changes once support is automated

- 70 to 85% of routine queries are resolved automatically

- Average handling time drops by around 80%

- Customer satisfaction improves by 30 to 40%

Human agents are no longer buried in repetitive requests. They focus on complex issues that genuinely require empathy, judgment, or negotiation.

What makes this especially powerful is accessibility.

RPA allows even small retail operations to deliver support experiences that feel on par with large enterprises. There is no need to build massive call centers or stretch teams thin across shifts. Support becomes consistent, responsive, and available at all hours, without driving up costs.

Over time, customer support stops being a constant firefighting exercise and becomes a reliable extension of the retail experience. Customers get answers when they need them. Teams regain capacity. And service quality scales without exhausting the people behind it.

RPA Solutions We’ve Delivered Across Industries

Over the years, Nalashaa has delivered RPA solutions across customer service, logistics, finance, and healthcare operations. Below are a few examples that highlight how RPA creates measurable impact when applied to the right business processes.

RPA Integrated with Chatbots for Banking Customer Support

A mid-sized banking and financial services company in the United States was struggling with manual customer service workflows, long resolution times, and declining customer confidence. Nalashaa integrated RPA with chatbots to automate application tracking, product inquiries, and email-based support.

The solution improved resolution accuracy from 30 percent to over 90 percent, reduced turnaround time from 24 hours to under 15 minutes, and eliminated the need for manual mailbox monitoring. Routine queries were resolved automatically, while complex cases were routed intelligently to human agents.

RPA for Logistics Scheduling, Tracking, and Invoicing

A Dallas-based trucking company with a growing fleet faced operational strain in appointment scheduling, shipment tracking, and invoice validation. Manual processes caused delays, errors, and high staffing costs.

Nalashaa deployed RPA to automate delivery scheduling, consolidate shipment tracking data, and validate invoices using OCR and rule-based checks. Scheduling accuracy increased to 98 percent, processing time dropped from 15 minutes to 2 minutes, and invoice errors were significantly reduced, allowing teams to focus on exception handling instead of routine coordination.

Automated Account Reconciliation for Manufacturing Finance Teams

A global drilling tool manufacturer needed to streamline account reconciliation as transaction volumes increased. Manual spreadsheet-driven reconciliation was slow, error-prone, and difficult to audit.

Nalashaa implemented RPA bots to extract bank statements and ledger data, reconcile transactions automatically, flag discrepancies, and generate reconciliation reports. The result was a faster reconciliation cycle, improved transparency, reduced errors, and better focus for finance teams on value-added activities.

RPA Bot for Invoice Classification in Healthcare

A leading European hospital required automation for invoice intake and classification from vendors. Invoices arriving via email were manually reviewed and categorized, causing delays and backlogs.

Using UiPath and OCR, Nalashaa implemented an RPA solution that scanned incoming emails, classified invoices based on logical identifiers, stored them correctly, and sent automated acknowledgements to vendors. This significantly reduced processing time and improved operational efficiency across finance operations.

Conclusion

These use cases of RPA in retail shows how automation can directly tackle many of the day-to-day challenges retail businesses face. From managing inventory and supply chains to engaging customers and preventing fraud, there’s a good chance that if you have a tedious process draining your team’s time, RPA can take it over and do it faster and error-free. Many successful RPA case studies in retail have already shown impressive results – like cutting order processing times from days to minutes or reducing data entry errors to near zero – proving that these aren’t just theoretical benefits.

The best part is that you don’t have to be a tech giant to start using RPA. Modern RPA tools are more accessible and often don’t require deep technical expertise. You can begin with a small pilot in one area (for example, automating inventory updates or invoice processing) and then expand as you see the returns. Retailers who embrace RPA often find that it boosts productivity, reduces costs, and even improves employee morale (since staff can focus on more meaningful work than copying and pasting data).

In a competitive market where customer expectations are only growing, leveraging RPA in retail operations is quickly moving from a nice-to-have to a must-have. By automating the mundane, you can deliver a smoother, faster, and more reliable experience to your customers and give your team the freedom to focus on innovation and customer service. In short, adopting RPA is like giving your retail business a supercharged assistant that works 24/7 – helping you stay ahead in the fast-paced world of retail.

Ready to explore RPA for your retail business? Start with one of these high-impact use cases and watch the transformation unfold. Your employees – and your customers – will thank you!